E-commerce and the automobile industry in the festive season are driving growth for the commercial vehicle industry.

The Covid-19 pandemic dealt another severe blow to the industry but things are looking up, , said Anuj Kathuria, COO, Ashok Leyland.

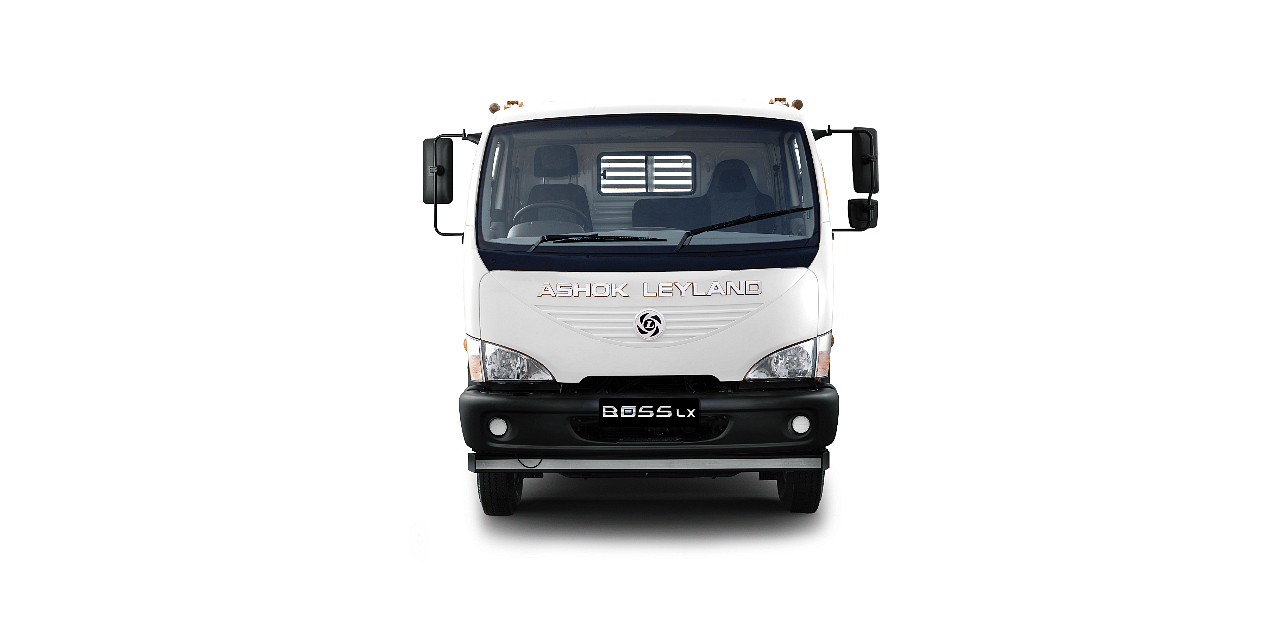

Kathuria was speaking on the sidelines of the launch of Ashok Leyland’s Boss LE and LX BS-VI trucks in the intermediate commercial vehicle (ICV) segment. These two vehicles will be in the 11.1 to 14.05 tonne GVW market. There are loading span options from 14 to 24 feet. Prices start from Rs 18 lakh (ex-showroom, Mumbai/ Delhi/ Chennai).

“E-commerce is one of the segments having more demand than some of the others. While there are a lot of negatives about Covid-19, the positive is that e-commerce has gone up and that is going to provide a lot of opportunities. But overall, we would be addressing all the segments possible including agriculture, perishables, poultry and pharmaceuticals,” Kathuria said.

“We are also seeing recovery in ICV and in construction and mining, road, infrastructure, movement of iron ore and coal. With the monsoon behind and festive season ahead, there will be faster recovery. We are getting into the festive season, there are specifics like two-wheeler outbound logistics, passenger car, movement of auto parts, petroleum movement, steel coil movement etc. Once industries like cement also revive, we will start seeing more traction,” he added.

Kathuria also said that the company is looking at more than GST rate cut and scrappage policy to drive demand. “We are looking at the demand drivers which are the mobilisation of various infrastructure projects. So, the faster they happen, the better for us. Even the increase in mining activity is another great driver for demand,” he stated.

“Volumes are getting better month after month, but it is very difficult to do long term planning. We are geared up for the opportunities that come up in the market, whether it is in terms of readiness of the product or engaging with supplier partners.

“ICV is an upcoming segment and recovery is happening faster than other segments. The ICV degrowth last year was limited as compared to other segments. The monthly number of ICVs that are being sold overall is somewhere between 3,500-4,000 vehicles,” he explained.

As far as Ashok Leyland is concerned, Kathuria said: “We are upwards of 20 per cent market share in the ICV segment. With all segments put together, we are in the range of upwards of 30 per cent. Therefore, we would like to get our ICV market share also at a similar level,” he remarked.