French carmaker Renault pledged more cost cuts and to focus on a smaller number of profitable models as its new boss laid out plans to revive a business hammered by management turmoil and the Covid-19 crisis.

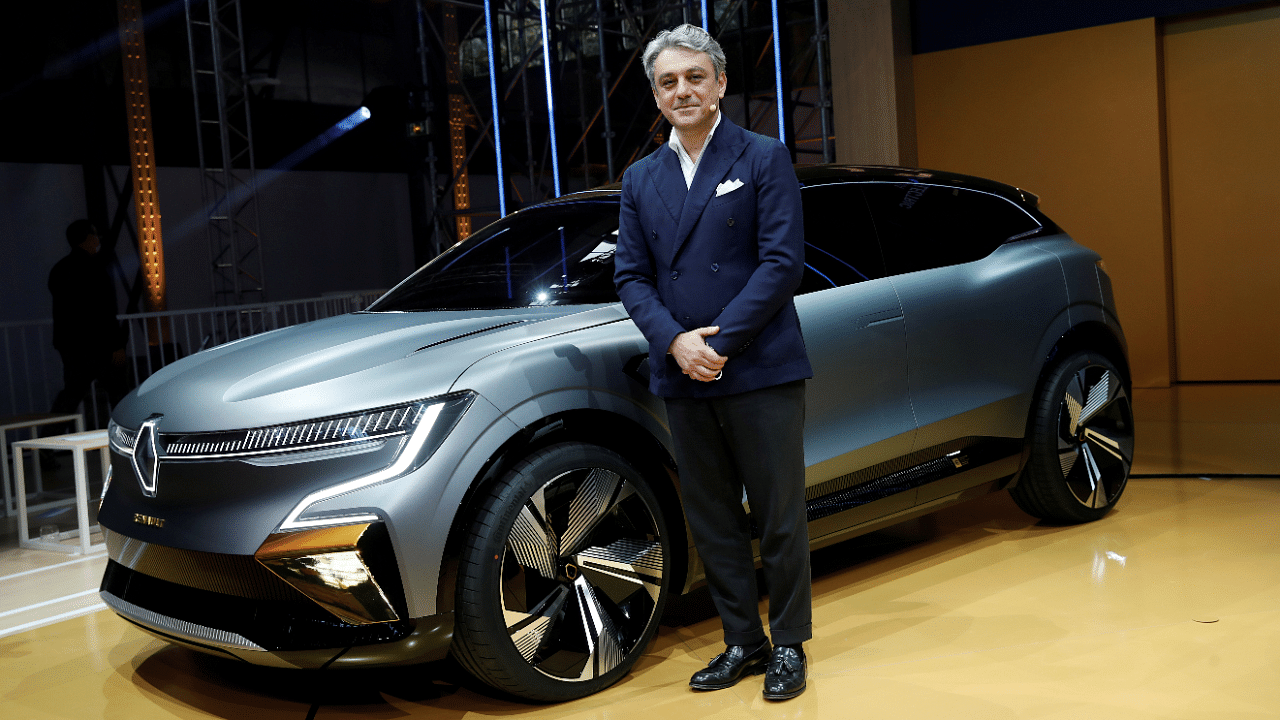

In his first strategy update since taking over in July, Chief Executive Luca de Meo said he would simplify manufacturing and rein in spending in areas like research, while cutting car production to 3.1 million units in 2025, from 4 million in 2019.

Focused on efficiency and profitability, Renault's new plan is a marked departure from the ambitious one laid out four years by former boss-turned-fugitive Carlos Ghosn.

Ghosn's strategy was built on growing car volumes globally - a plan critics say forced the carmaker to pursue size over profits.

"We grew bigger but not better," De Meo said during an online presentation on Thursday, adding that the task now was to "steer our business from market share to margin."

To do that, Renault will build vehicles on fewer shared platforms to pare back costs by 600 euros ($730) per car by 2023. Half of Renault's vehicle launches will be electrified versions by 2025, and electric models should have better profit margins than their fossil-fuel equivalents, the carmaker said.

In a note to clients, Jefferies analyst Philippe Houchois described the company's new profit targets as "underwhelming," reflecting the "depth of challenges at Renault."

Renault plans to cut development time for a new vehicle by a year, to under three years and announced a new business unit, called Mobilize, focused on "new profit pools" from data, mobility and energy-related services.

De Meo, who previously ran Volkswagen's Seat brand, aims to derive at least 20% of Renault's revenue from that business by 2030.

"We'll move from a car company working with tech to a tech company working with cars," he said.

Renault was struggling with waning sales even before the Covid-19 crisis and has been trying to get a partnership with Japan's Nissan back on track.

Renault on Thursday hiked its cost savings target by 500 million euros to 2.5 billion euros by 2023, and set goals to gradually ramp up operating margins, reaching 5% by 2023.

The company also plans to lower capital spending and research costs to 8% of revenue from 10% by 2025.

Together, these measures should lower Renault's break-even point by 30% by 2023.

Renault has yet to publish margins for 2020, though following the Covid-19 pandemic which disrupted operations, they are likely to be lower than the 4.8% hit in 2019.

Renault said it was targeting automotive free cash flow of 3 billion euros by 2023, and 6 billion by 2025.

"At the margin the commitment to short-term cash targets is positive as it remains the key concern for investors," Citibank analysts wrote in a client note. "The greater details around how Renault moves on to a sustainable footing is also welcome given Renault shares continue to trade at a marked discount to peers."