The status quo by the Reserve Bank was termed as a "prudent step" by the lending community, but measures on the regulatory front like restructuring and increase in lending against gold were welcomed.

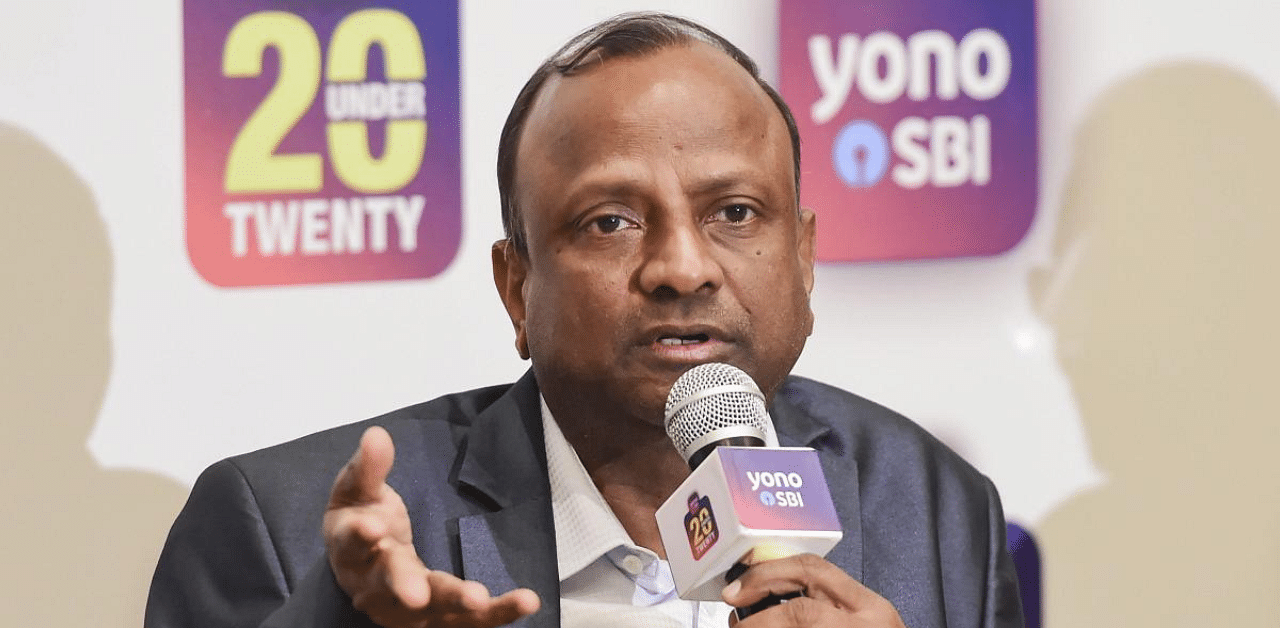

Rajnish Kumar, chairman of SBI, who also heads the Indian Banks' Association, said the outlook on growth "continues to be negative" and pointed out that the RBI has refrained from giving a number on the contraction of the economy, while inflation trajectory is "uncertain".

The RBI paused after two deep cuts as the inflation rose beyond the upper end of its target band for July, and the real interest rates – the differential between inflation and lending rates – turned negative. It maintained the accommodative stance and promised to act the moment inflation ebbs.

"The decision to hold the policy rate is a prudent one in the prevailing circumstances as the trajectory of economic growth, inflation and external demand continues to remain uncertain," Kumar said in a statement.

"The RBI has addressed the need to offer some form of restructuring facility for standard accounts that are facing difficulty in debt restructuring. We welcome the fact that a new Resolution Framework for Covid-19-related stress facility has been extended to large corporate, SME and personal loans with necessary safeguards in each segment," he added.

Bank of India's managing director and chief executive A K Das said the RBI policy has "several positive" measures which will help in financial stability, including additional liquidity of Rs 10,000 crore to the National Bank for Agriculture and Rural Development (NABARD) and the National Housing Bank (NHB) towards directed lending to NBFC and HFC, extension of timeline of MSME restructuring, and incentive scheme for priority sector lending.

Peer Indian Bank's managing director and chief executive Padmaja Chunduru termed the monetary policy committee's call as “pragmatic” as the accommodative stance has been maintained.

Also read: RBI announces special liquidity facility of Rs 10,000 cr for Nabard, NHB

Kumar said at present, the demand shock is appearing to “net out” the supply shock on the price levels front.

Private sector lender Kotak Mahindra Bank's group president Shanti Ekambaram said the policy was on expected lines and welcomed the much-awaited restructuring scheme for the MSME sector, saying it will provide additional relief to a sector deeply impacted by the Covid-19 pandemic.

Non-bank lender Shriram Transport Finance's managing director and chief executive Umesh Revankar welcomed the move to end moratorium and instead go for a case specific restructuring.

"The central bank has decided not to extend the moratorium and has instead allowed lenders to restructure some loans which is a positive change as account classification will remain standard and this will also ease provision requirements ahead," he said.

Among the foreign lenders, Standard Chartered Bank's Zarin Daruwala said the policy move to take a pause was on expected lines.

"The market will take comfort that it has left the door open for further easing given Covid-19 related uncertainties. The resolution framework should help reduce the strain on the balance sheets of corporates operating in affected sectors in a meaningful way and the revised priority sector lending norms should improve funds flow to credit-starved districts," she said.