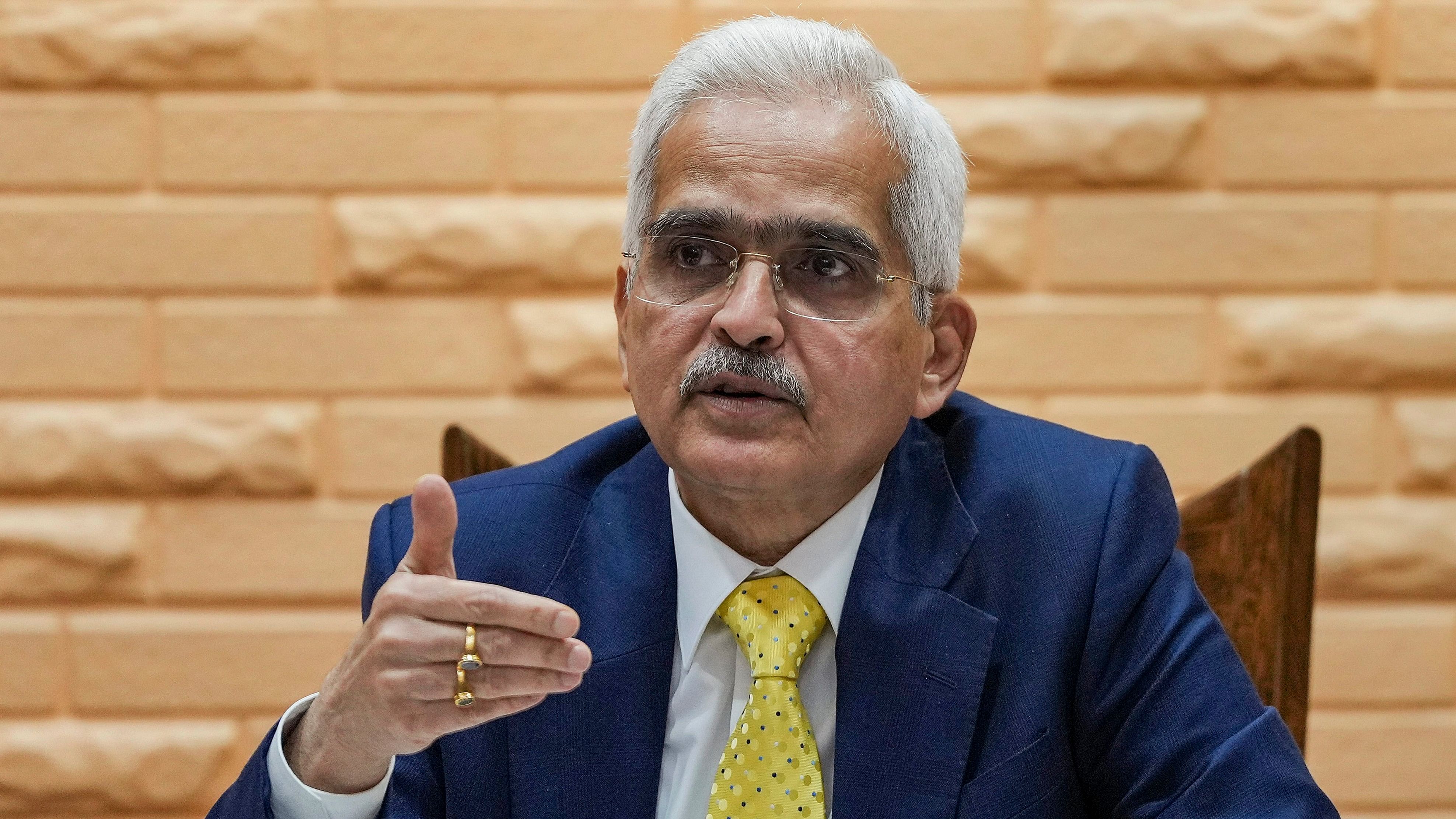

Reserve Bank of India (RBI) Governor Shaktikanta Das addresses a press conference after a customary post-budget meeting with the Central Board of Directors of Reserve Bank of India, in New Delhi, on Monday.

Credit: PTI Photo

New Delhi: Dashing any hope of relief to Paytm Payments Bank, Reserve Bank of India (RBI) Governor Shaktikanta Das on Monday said the regulatory action by the central bank has been taken after much consideration and deliberation and there is hardly any scope for review.

“There is hardly any room for review. The word review being used is not appropriate. Our priority is that the customers should not face any inconvenience so we have given one month's time,” Das told reporters after a meeting of the Central Board of Directors of the RBI in New Delhi.

“The decisions we make at the Reserve Bank are carefully considered. Whether it's a bank, payment bank, non-banking financial company, cooperative bank, or any other entity, if we take action against them after months, a year, or two years, we do so after careful deliberation,” he said.

In a major jolt to Vijay Shekhar Sharma-led Paytm, the RBI on January 31 ordered its payment bank arm Paytm Payments Bank to stop all activities after February 29. So from March 1, 2024 onwards there will be no deposits, credit transactions, wallet top-ups or bill payments from Paytm Payments Bank.

While the central bank has barred Paytm Payments Bank from carrying out any banking related activities, it has not cancelled its payments bank license.

The RBI action has created uncertainty and confusion on Paytm app business.

Das said the RBI will issue FAQs (frequently asked questions) to address the confusion related to Paytm. “We will release the FAQ this week. I request you to wait until that FAQ is released,” said Das adding the FAQ will deal with customer interest issues.

“The action was taken on January 31st, and we have given time until February 29th. We have provided this time because the transition, customer interest, and depositor interest are always our top priorities,” he added.

Meanwhile, the 606th meeting of the Central Board of Directors of the RBI was held on Monday under the chairmanship of Governor Das. As is customary, the RBI’s first board meeting after any union budget is held in New Delhi and is attended by the finance minister.

Finance Minister Nirmala Sitharaman addressed and interacted with the directors of the RBI’s central board and highlighted the key thrust areas outlined in the interim Union Budget 2024-25 and the expectations from the financial sector, according to an official statement released after the meeting.