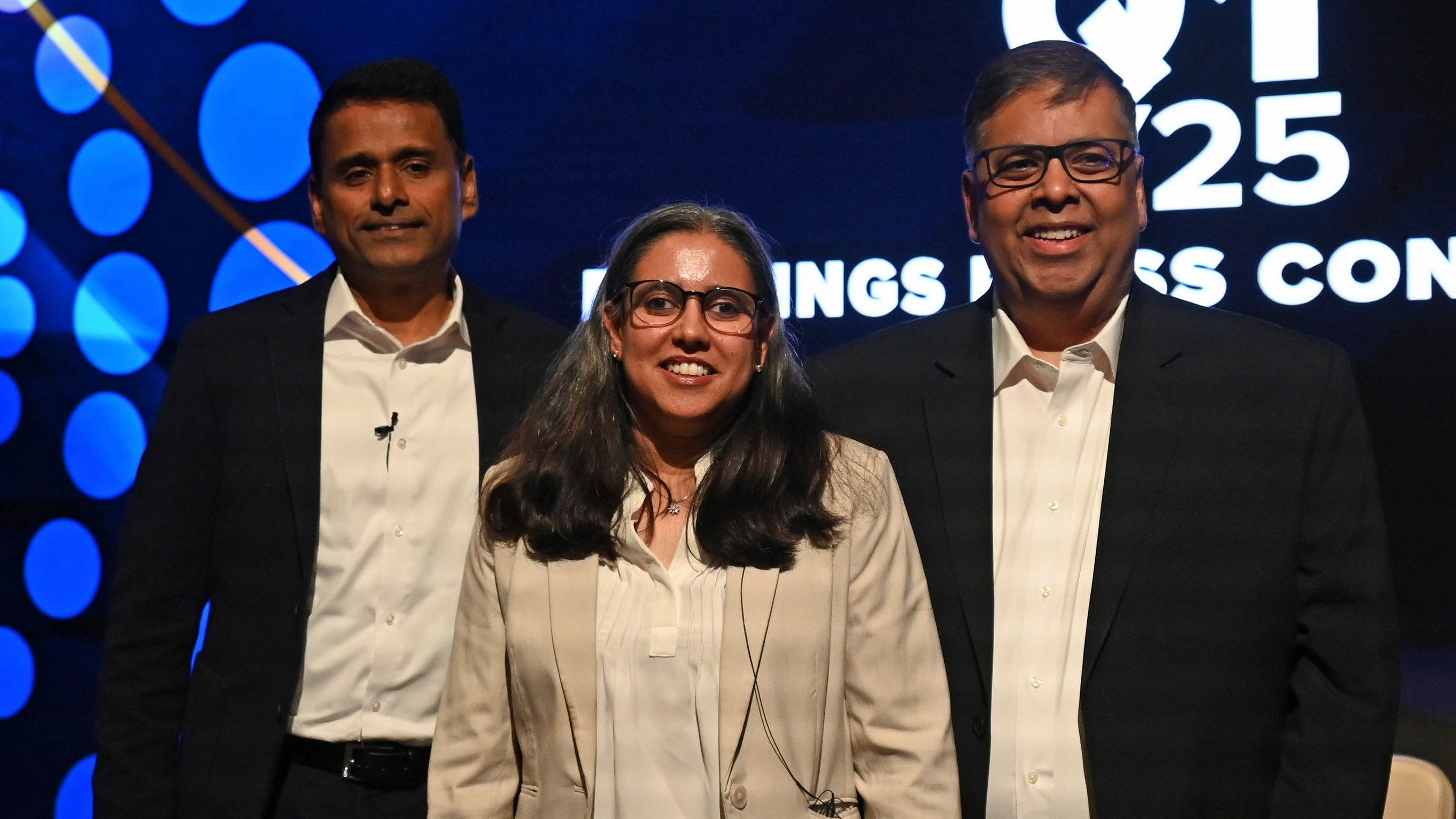

(L-R) Wipro's CEO and Managing Director Srini Pallia, Chief Financial Officer Aparna Iyer and Chief Human Resources Officer Saurabh Govil during the quarterly results announcement in Bengaluru on Friday.

Credit: DH PHOTO/PUSHKAR V

Bengaluru: IT services major Wipro missed analyst estimates as its revenue fell 3.8 per cent on a year-on-year basis in the first quarter (Q1) of the current fiscal year, clocking a consolidated turnover of Rs 21,964 crore. However, net profit saw an uptick of 4.6 per cent at little over Rs 3,000 crore on an annual basis, beating D-Street expectations.

It also marginally raised its sequential revenue guidance to -1 per cent to 1 per cent after slashing it to -1.5 per cent - 0.5 per cent in the previous quarter. “We recorded another quarter of total large deal bookings over $1 bn, with our largest win in recent years. We are pleased with the momentum we have built in Q1 across industries and sectors and confident in our ability to execute better on bookings and profitable growth as we transition to Q2,” said Srini Pallia, chief executive officer and managing director of Wipro.

The company said it would take in 10,000-12,000 freshers this fiscal year, hiring both from on and off campus,in line with the present industry trend. Additionally, they are in process to complete the onboarding of 3,000 employees.

While total bookings stood at $3.3 billion, the total contract value (TCV) of large deal was at $1.2 billion. Wipro saw a marginal headcount growth this quarter, going up to 2,34,391, coupled with net utilisation of 87.7 per cent excluding trainees. While the attrition rate remained muted for this quarter, Wipro expects an uptick in the numbers going ahead.

It saw better demand from North America and expects the momentum of growth to sustain given signs of inflation there getting under control that could have the Fed more inclined to cut interest rates.

“We are also expecting a positive growth in banking, financial services and insurance vertical in the next quarter. We continue to see deal momentum and it’s reflecting in our deal pipeline,” added Pallia in a press briefing post earnings.

Aparna Iyer, Chief Financial Officer, said “We continued to expand our margins to 16.5 per cent in Q1’25. This is a 42 basis points improvement YoY. Our margin performance is also reflected in our EPS (earnings per share) increase of 10 per cent YoY. Our operating cash flows continue to be strong at 131.6 per cent of our net income which takes our current investment and cash balance to $5.4 billion.”

"Wipro’s revenue saw a slight decline compared to the previous year, but we are optimistic about the future given a strong pipeline of business opportunities . Although the current conservative approach of buyers is impacting the IT sector, the expected rise in global IT spending in the upcoming quarters supports a positive long-term outlook,“ commented Biswajit Maity, Senior Principal Analyst at the consulting firm, Gartner.