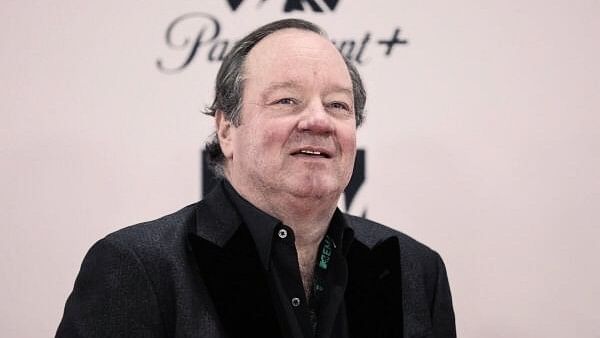

Bob Bakish.

Credit: Reuters

Shari Redstone, the owner of Paramount, has tried to resist the erosion of her media empire over the past decade as she confronted the death of cable TV, the rise of streaming and even a failed boardroom coup from a longtime ally.

By her side through it all has been Bob Bakish, Paramount's CEO. For years, she saw him as a loyal lieutenant who could navigate the treacherous entertainment industry with the financial dexterity of the former management consultant he once was. As Paramount's share price sagged, she was patient with him -- even as she steered the company toward an eventual sale that he had reservations about.

That patience officially ran out Monday.

Bakish is stepping down effective immediately, the company announced Monday, a stunning shake-up in the top ranks of the company as it considers a major merger.

Bakish, 60, will be replaced by an "office of the CEO" run by three executives: Brian Robbins, head of the Paramount movie studio; George Cheeks, CEO of Paramount's CBS division; and Chris McCarthy, CEO of Showtime and MTV Entertainment Studios.

Looming over Bakish's exit are broader questions about the future of Paramount. Like many media companies, Paramount has struggled in recent years to get its streaming business off the ground as audiences for its cable channels have diminished. As a result, Paramount has long been considered an acquisition target by rivals looking to build up their content libraries and increase their leverage in cable negotiations.

In recent months, the company has been in discussions to merge with Skydance, a media company run by tech scion and Hollywood executive David Ellison. Redstone, who is Paramount's controlling shareholder, has signed off on a potential deal for her stake, but the company's directors have yet to reach an agreement for the whole company.

Several shareholders have come out publicly against a combination with Skydance, saying it would enrich Redstone at the expense of other investors. The private equity firm Apollo and Sony have discussed making an all-cash bid for Paramount, an offer that could give the company a serious alternative. But any talks with other suitors must wait until the exclusive negotiation period with Skydance lapses in early May.

In an effort to assuage those concerns, Skydance in recent days sweetened its proposal to acquire Paramount. The company told Paramount it would provide a $3 billion cash infusion to pay down debt and buy back shares, money that would come from the private equity firm Redbird Capital and the Ellison family. Skydance also offered to give Paramount shareholders a larger stake in the combined company than it previously contemplated.

It is unclear if Skydance's sweeteners will be enough to convince the special committee of board members evaluating the merger with Skydance that the deal treats all shareholders fairly. The rare nature of Bakish's departure could put extra pressure on the committee to show they're negotiating the best deal for shareholders, said Jim Woolery, founder of Woolery & Co., an advisory firm.

"It creates a point of leverage," said Woolery, who has advised many special committees. He said it was now more likely that the special committee would open up deal talks with Apollo and Sony or consider allowing rival bidders to step in after any deal with Skydance is signed and giving Skydance the right to match a higher offer.

Bakish has been an employee of Paramount since 1997, and he and Redstone have been allies for years. He took over as CEO in 2016 after a rift opened between the Redstone family and one of his predecessors, Philippe Dauman, and Bakish was her preferred candidate to run the company after it merged with CBS in 2019.

But Redstone's relationship with Bakish began deteriorating over the past year, three people familiar with their interactions said. Ms. Redstone perceived he had missed opportunities to strike lucrative deals for the company, including a sale of its Showtime and BET cable networks, they said. In 2021, the private equity firm Blackstone expressed interest in acquiring the Showtime cable network for at least $5.5 billion, an eye-watering sum for a business in long-term decline, one of the people said. Paramount did not pursue that deal.

The Wall Street Journal earlier reported on Blackstone's interest in Showtime.

Bakish is in line for a big payday. According to the data firm Equilar, he is entitled to a severance package of $50.6 million, with $31 million of that in the form of cash for the two years after his employment is terminated.

Redstone came to believe that Bakish wasn't moving with enough urgency to get Paramount on firmer footing, the three people said. Bakish also told the special committee this year that he had reservations about the company's merger with Skydance, one of the people said.

Bakish's position became untenable in recent weeks after he presented a long-term plan to the special committee that Redstone believed did not adequately reflect the input of the company's top executives, including Robbins, Cheeks and McCarthy, the three people said. Redstone approved discussions between those executives and representatives of the board, including Charles Phillips. During the conversations, the executives expressed misgivings about the direction of the company, the people said.

Bakish's departure marks the end of an important chapter in Paramount's history. He was a pioneer of a strategy to offer streaming entertainment directly to consumers, creating the Paramount+ streaming service and acquiring Pluto TV, a free, ad-supported streaming service.

Bakish had an unlikely path to the top of Paramount. A former consultant at Booz Allen Hamilton, he joined Viacom, Paramount's predecessor, after advising Paramount Communications on strategy for its Madison Square Garden division. Bakish rose to become head of Viacom's international channels division, and was tapped in 2016 to succeed Tom Dooley as CEO.

He got the top job during a perilous time for Viacom. The company's bellicose approach to negotiations with cable companies -- its most important partners -- resulted in its being dropped by the Suddenlink cable system in 2014. Viacom's share price tumbled. Bakish took a more measured approach to negotiations, improving the relationship with cable providers and stabilizing the company.

Despite those efforts, Paramount's share price has continued to sink over the years, reflecting investors' skepticism about the cable TV business. Over the past year, the price has fallen 48 per cent as the cable bundle -- once an industry-defining juggernaut -- continues to lose subscribers.

After more than a quarter-century at the company and its predecessor, Bakish's send-off from Paramount was unceremonious. In brief remarks at the end of the company's first-quarter earnings call, Paramount's chief financial officer offered his former boss terse congratulations on navigating "a number of challenges."

He did not take any questions.