Stocks started a busy week with guarded gains as investors gauged the chance of added US fiscal and monetary stimulus, while the British pound rose in relief as a last-gasp extension to Brexit talks dodged a hard divorce.

Progress on coronavirus vaccines cheered risk sentiment, with the first shipments speeding across the United States as part of a historic mission to innoculate more than 100 million people by the end of March.

E-Mini futures for the S&P 500 responded by rising 0.5%, while March Treasury bond futures slipped 5 ticks.

MSCI's broadest index of Asia-Pacific shares outside Japan edged up 0.1%, having hit a string of record highs last week.

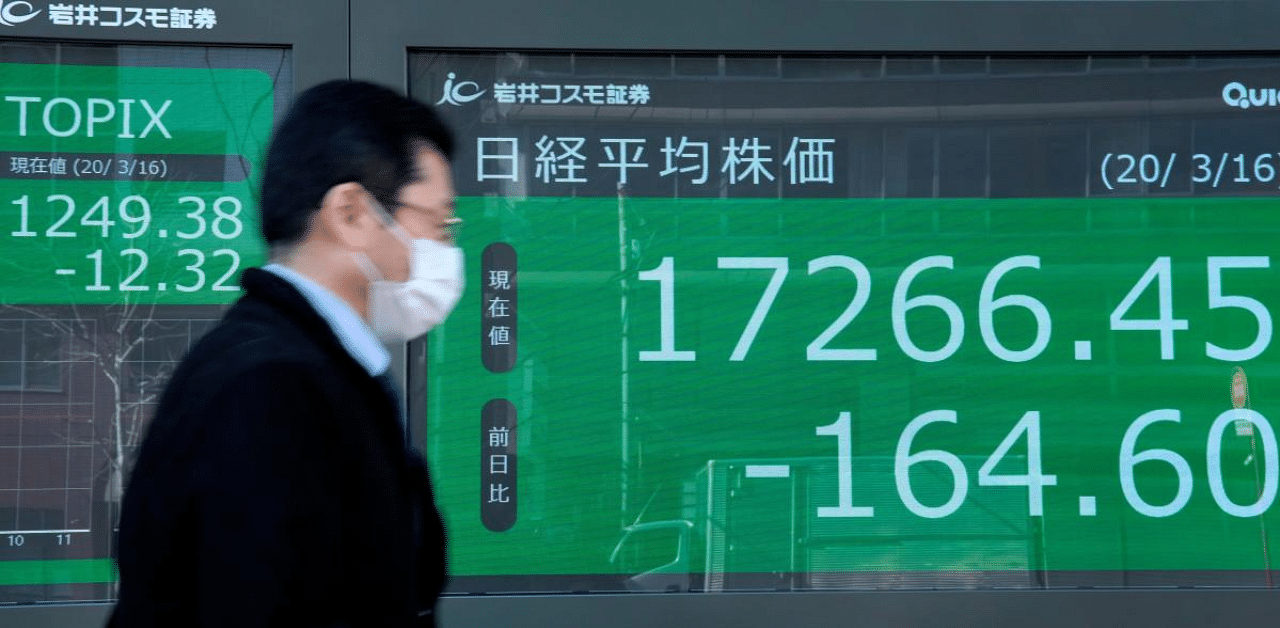

Japan's Nikkei added 0.4% as a survey showed the mood among hard-hit Japanese businesses had improved in the December quarter.

Sterling firmed on both the euro and the dollar after Britain and the European Union agreed to continue talks on post-Brexit trade beyond Sunday's deadline.

Against the dollar, the pound rose 0.7% to $1.3314 and away from Friday's close of $1.3222. The euro slipped 0.5% to 91.09 pence, off a three-month top of 92.29.

"Our base case remains that a 'thin' free trade agreement will be reached before the end of the year," analysts at Goldman Sachs wrote in a note.

"That said, there is plenty of uncertainty and our economists, given the lack of progress in recent weeks, now see rising risks of a no-deal outcome."

That could see the euro climb to 96.00 pence, while a deal could send the pound rallying to 87.00 per euro, Goldman predicted.

The single currency has already been charging hard against the US dollar, which many analysts believe has entered a cyclical downtrend as the prospect of a vaccine-driven global economic recovery lessens the need for safe havens.

The euro was up 0.2% on Monday at $1.2135 and within striking distance of its recent 31-month top of $1.2177. The dollar index eased to 90.734 and nearer to its recent trough of 90.471.

An added hurdle for the dollar will be the Federal Reserve's policy meeting on Dec. 15-16. The market is assuming the central bank will merely refine its forward guidance on policy rather than buying more bonds or "twisting" its portfolio to add more longer-dated debt.

"The risk is then if the Fed does unveil a surprise twist at this meeting, then Treasuries could rally and the USD could fall," said Tapas Strickland, a director of economics at NAB.

An extra wrinkle is the chance of a U.S. deal on fiscal stimulus after a top Democrat hinted they might compromise to get an agreement past Republican objections.

All the talk of stimulus has helped put a floor under gold, leaving it a shade lower at $1,836 an ounce. Considered a hedge against inflation and currency debasement, gold has gained more than 21% this year.

Oil prices edged higher on Monday having now rallied for six weeks straight as investors priced in a global recovery next year.

US crude firmed 11 cents to $46.68 a barrel, while Brent crude futures rose 12 cents to $50.09.