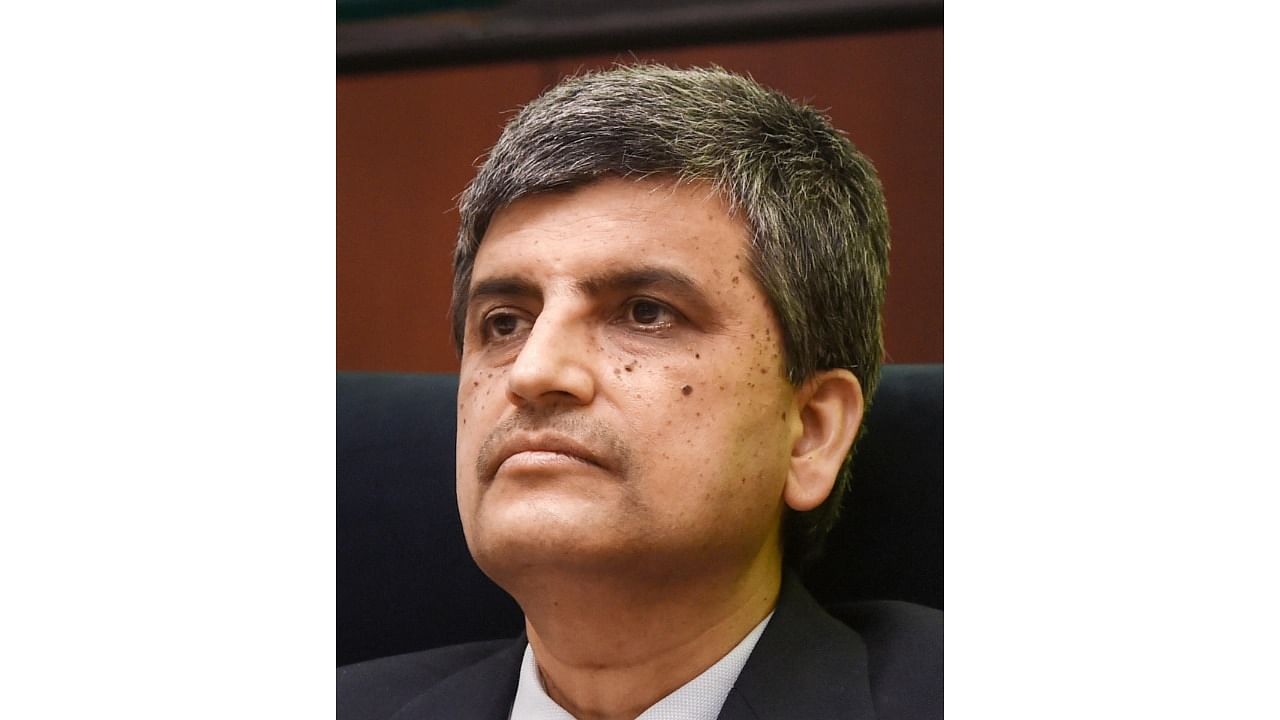

The government does not see any adverse impact on the Indian economy post the US Federal Reserve's decision to raise interest rates by 75 basis points, Economic Affairs Secretary Ajay Seth said on Thursday.

"All central banks are grappling with it and taking adequate measures which are needed to control the inflation. I see fair amount of coordination ...directly or indirectly they are moving in tandem," Seth told reporters.

"So, I don't see any adverse impact of that (rate hike by Fed) because Reserve Bank of India, in the two previous cycles, has already taken adequate measures," he said.

On Wednesday, the US Federal Open Market Committee, on expected lines, raised the target range for federal funds rate by 75 basis points to 1.50-1.75 per cent. It also said it would hike rates aggressively in the rest of the calendar year.

Citing upside inflationary pressures, the RBI has raised interest rates by 40 basis points and 50 basis points respectively in May and June to 4.9 per cent.

Since May, the government has announced a host of steps to curb inflationary pressures, including a cut in excise duty on petrol and diesel and reduction in import duty on some raw materials used in iron and steel and plastic industries.

Seth said inflation in India is mainly because of high energy and food prices and hoped that it would moderate in the coming months.

"We are all aware that summer months are the difficult months in terms of vegetables and other items," Seth said.

Inflation rate based on the wholesale price index rose to a record high of 15.88 per cent in May due to sharp increase in prices of food items and crude oil.

Retail inflation based on the consumer price index (CPI) moderated to 7.04 per cent in May from a near eight-year high of 7.79 per cent in April, largely due to a favourable base.

"High crude prices are certainly a challenge and whatever measures are needed and feasible are being taken," Seth said.