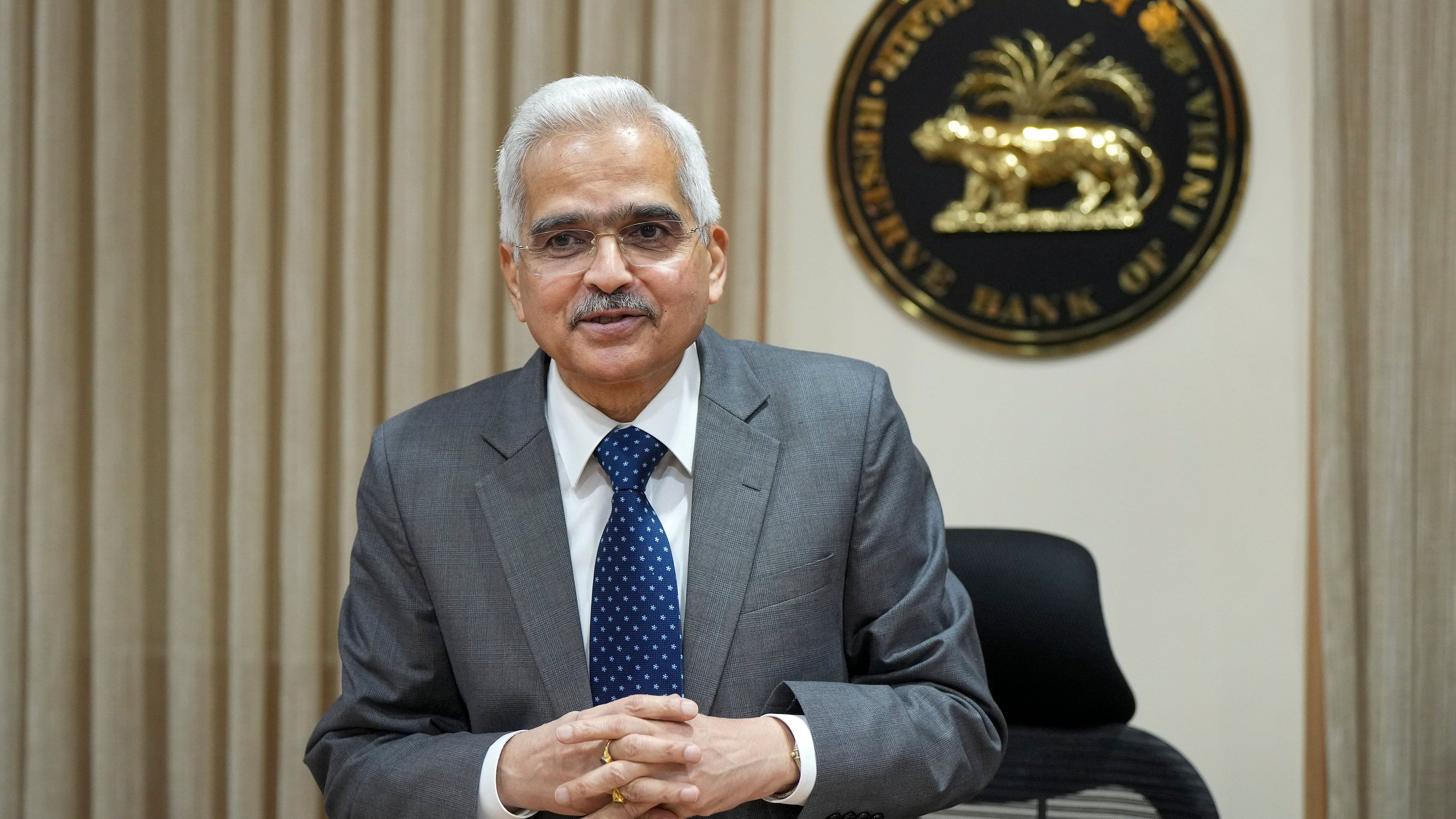

Reserve Bank of India (RBI) Governor Shaktikanta Das during a press conference on monetary policy statement.

Credit: PTI Photo

new Delhi: The Reserve Bank of India's monetary policy committee (MPC) on Friday decided to keep key policy interest rates unchanged for the seventh time in a row, in line with the market expectations, and reiterated commitment to bring down inflation to its target of 4 per cent on a sustainable basis.

In its first monetary policy review of the current financial year, the central bank also kept its projections for GDP growth and inflation unchanged.

The six-member rate setting panel through a 5:1 majority decided to keep repo rate unchanged at 6.5 per cent. Repo rate is the interest rate at which the RBI lends short-term funds to banks.

The standing deposit facility (SDF) rate has been kept unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. These key policy rates that determine the lending and borrowing rates by the commercial banks and other financial institutions have not changed since February 2023.

The MPC, with a 5:1 majority, also decided to keep its stance of "withdrawal of accommodation" unchanged.

RBI Governor Shaktikanta Das said the central bank would remain focused on bringing down inflation to 4 per cent.

“As the uncertainties in food prices continue to pose challenges, the MPC remains vigilant to the upside risks to inflation that might derail the path of disinflation,” Das said.

“The MPC will remain resolute in its commitment to aligning inflation to the target,” he added.

According to the monetary policy statement, unpredictable supply side shocks from adverse climate events and their impact on agricultural production as also geo-political tensions and spillovers to trade and commodity markets add uncertainties to the inflation outlook.

“The RBI's decision to maintain the repo rate unchanged is significant as it monitors upside risks to inflation,” said Anshuman Magazine, Chairman & CEO - India, South-East Asia, Middle East & Africa, CBRE.

“This consistent stance of RBI underscores managing price stability amidst inflationary pressures,” Magazine added.

The RBI has kept its GDP growth projection for FY 2024-25 unchanged at 7 per cent with Q1 at 7.1 per cent; Q2 at 6.9 per cent; Q3 at 7.0 per cent; and Q4 at 7.0 per cent.

An expected normal south-west monsoon should support agricultural activity. Manufacturing is expected to maintain its momentum on the back of sustained profitability. Services activity is likely to grow above the pre-pandemic trend. Private consumption should gain steam with further pick-up in rural activity and steady urban demand, the RBI noted in its monetary policy statement.

The prospects of fixed investment remain bright with business optimism, healthy corporate and bank balance sheets, robust government capital expenditure and signs of upturn in the private capex cycle, it said.

However, the MPC also underlined risks to the economy. “Headwinds from geopolitical tensions, volatility in international financial markets, geo-economic fragmentation, rising Red Sea disruptions, and extreme weather events, however, pose risks to the outlook,” it said.

For the current financial year the RBI has pegged the headline retail inflation at 4.5 per cent with Q1 at 4.9 per cent; Q2 at 3.8 per cent; Q3 at 4.6 per cent; and Q4 at 4.5 per cent. These projections are based on the assumption of a normal monsoon.

“While low core inflation provides comfort, the uncertainty on food inflation remains a worry,” said Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank.

Bhardwaj added that the RBI is unlikely to cut policy interest rates until the second quarter of the current financial year. “Earliest possibility of rate easing can emerge in Q3 FY25,” she added.

“Overall, the macro environment is likely to turn favourable for a rate cut by mid-2024 in our base case, lest oil prices and monsoons play a spoilsport,” said Dharmakirti Joshi, Chief Economist, CRISIL.