The Reserve Bank of India raised its key lending rate by 35 basis points to 6.25 per cent, pushing up the EMIs of existing loan holders and hurting the prospects of seekers of floating-interest loans as they are bound to pay a higher rate of interest on the same amount of principal with each rate-hike.

Wednesday’s move, which was in line with economist expectations, came after the RBI implemented three consecutive 50-basis-point hikes to fight persistent inflation in Asia’s third-largest economy. One basis point is one-hundredth of one percentage point.

The RBI has raised interest rates by 2.25 percentage points since May, including Wednesday’s increase of 0.35 percentage points, and the latest repo rate of 6.25 per cent is at the highest level it has been since 2018.

“From the consumers’ perspective, the rate hike will see an increase in EMIs, but is likely to be absorbed by some segments like home and car buyers, where the demand is quite robust. However, there is likely to be an impact on small loans (tied to) two-wheeler and consumer durable loans and microfinance sector,” said Sugant R, Dean - School of Economics and Commerce, CMR University.

Real estate industry experts played down the concerns.

“This hike will undoubtedly push up home loan interest rates, which had already crept up after four consecutive rate hikes this year. However, as long as interest rates remain in single digits (mainly within 9.5 per cent), the impact on housing will at best be moderate,” said Anuj Puri, the chairman of Anarock group.

Inflation fight

The RBI, which maintained its inflation forecast for FY23 at 6.7 per cent, made it clear it was not done with its fight against pricing pressures.

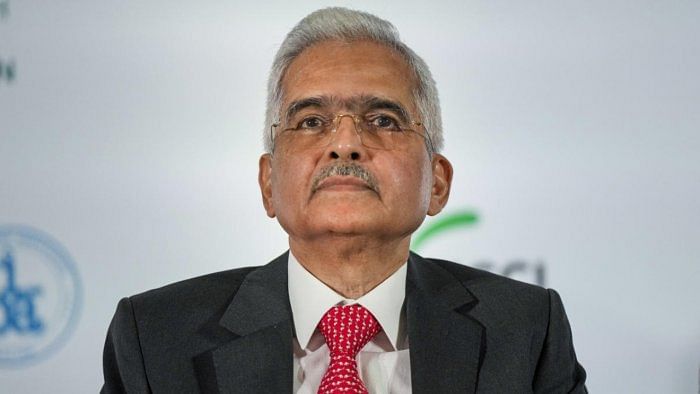

“Growth in India remains resilient and inflation is expected to moderate. But the battle against inflation is not over,” RBI Governor Shaktikanta Das said, citing pressure points such as high and sticky core inflation and exposure of food inflation to international factors and weather events.

Economists see more moderate rate increases ahead.

“This (rate hike) suggests that there may be more room for another shallow increase of up to 25 basis points to reach a neutral rate, though this does not necessarily imply the end of the cycle,” said Madhavi Arora, Lead Economist, Emkay Global Financial Services.

Others suggested that it would be premature to end the rate hikes.

Considering the policy crisis at a global level, ending the tightening cycle soon could worsen the rupee, said Arun Singh, Global Chief Economist, Dun & Bradstreet.

“In spite of the rate hike, India’s real (inflation-adjusted) interest rates remain below the RBI’s estimated natural rate of interest i.e. between 0.8 per cent and 1 per cent. This suggests that there is scope for a further rate hike,” he said.

The RBI also cut its real GDP forecast to 6.8 per cent from 7 per cent for FY23.

“Even after this revision in our growth projection for 2022-23, India will still be among the fastest-growing major economies in the world,” Das said. Nevertheless, it won’t be an easy task, Singh pointed out.

“Supporting currency and ensuring growth impulses are going to be difficult tasks to maintain amid the uncertainties surrounding the pace of global inflation and impending recessions,” he said.