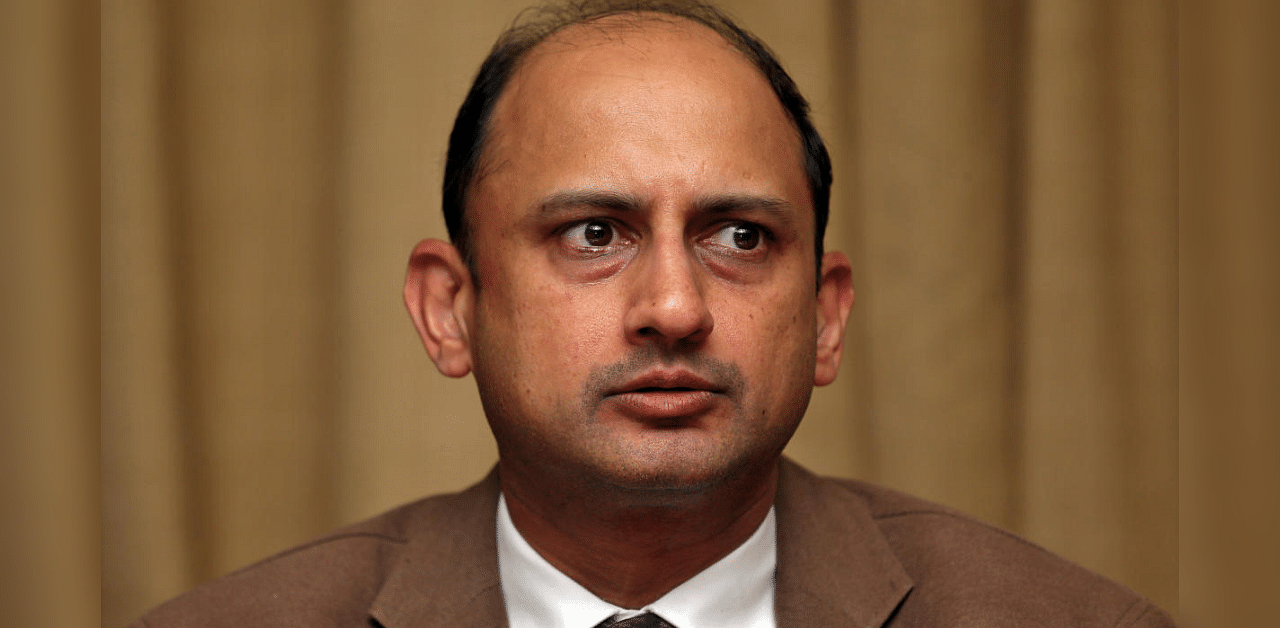

Blaming the bank clean-up efforts of former RBI governors Urjit Patel and Raghuram Rajan for the current slowdown is a "tragedy", former deputy governor of the central bank Viral Acharya said on Tuesday.

The public sector banking system is akin to a massive bad bank which has gobbled up USD 100 billion of taxpayer money in the last decade without delivering results, but no one cares about it because of the 'sab chalta hai' (anything goes) attitude, Acharya added.

"Even now, there is a concern that what Dr Rajan and what Dr Patel tried to do was a mistake, (that) India is not ready for it and it really baffles me.

"To think that central bank efforts to clean up and institutionally lift the quality of regulation were a mistake, to me that is a tragedy," Acharya, who resigned ahead of the completion of his term to go back to teaching in New York, said.

He was speaking at the virtual launch of journalist Tamal Bandyopadhyay's book 'Pandemonium: The Great Indian Banking Tragedy'.

Acharya worked under Patel when much of the clean-up efforts were carried out. Under Rajan, the RBI had begun an asset quality review to find out hidden stress in balance sheets which led to a massive jump in dud assets, higher provisioning and eroded profits for lenders.

Acharya said there are analysts who blame the efforts undertaken by RBI under Rajan and Patel for the current slowdown.

"When I see analysts talking about attributing the current slowdown to these governors, I feel really saddened that India doesn't recognize the good that some people have tried to do to put it on a better path," he said.

Acharya said in India, banks do not like to be "earnest" about the quality of their balance sheets and usually it takes over four years before an asset is recognized as being dud and provided for.

Without explicitly blaming the government, Acharya said everyone knows who has "killed" the Indian banking system and cited opinions of Rajan and other former governors including Y V Reddy, C Rangarajan, D Subbarao in the book, and also committees like the P J Nayak panel which spoke about the need to lessen the government's role.

"We don't have governance in place for the public sector banks (PSBs). The government as the owner has failed, it has not empowered the boards to run the PSBs well and there is no discipline on the management through the shareholders," he said.

Speaking at the event, Subbarao acknowledged that NPA problems happened during his tenure, but added there were reasons beyond cronyism as well for the bad loans mess.

These would include the push for restructuring of assets from RBI which would have helped some insolvent accounts stay afloat, court interventions and a sense of policy paralysis under the Manmohan Singh government, he said.

Acharya further said no one cares about the problems as well because of the 'sab chalta hai' attitude.

"My observation is that no one seems to care because the entire social cost is being equalized through the taxpayer money. I think the real tragedy is for the children and the youth of our country who don't have as bright a future as we could provide them," he added.

Acharya said in the last decade, over USD 100 billion has been thrown at the state-run lenders either by way of capital costs or the opportunity costs without much success and added that the same money could have been well utilised in fighting the COVID-19 pandemic.

A fix has not been found for the problems plaguing the PSBs for over three decades now, whereas in case a private sector bank goes rogue, there are ways of disciplining through the markets and otherwise, he pointed out.

"Every time I look at it, I reach at no other conclusion rather than saying that we are basically running a massive bad bank and continuing to operate with it rather than running it off as quickly as possible.

"If you don't have good governance working from your owner, from the external shareholders, from the regulators collectively keeping the ship (PSBs) in a good way on its journey, you will have more accidents than in other parts of the world," Acharya warned.