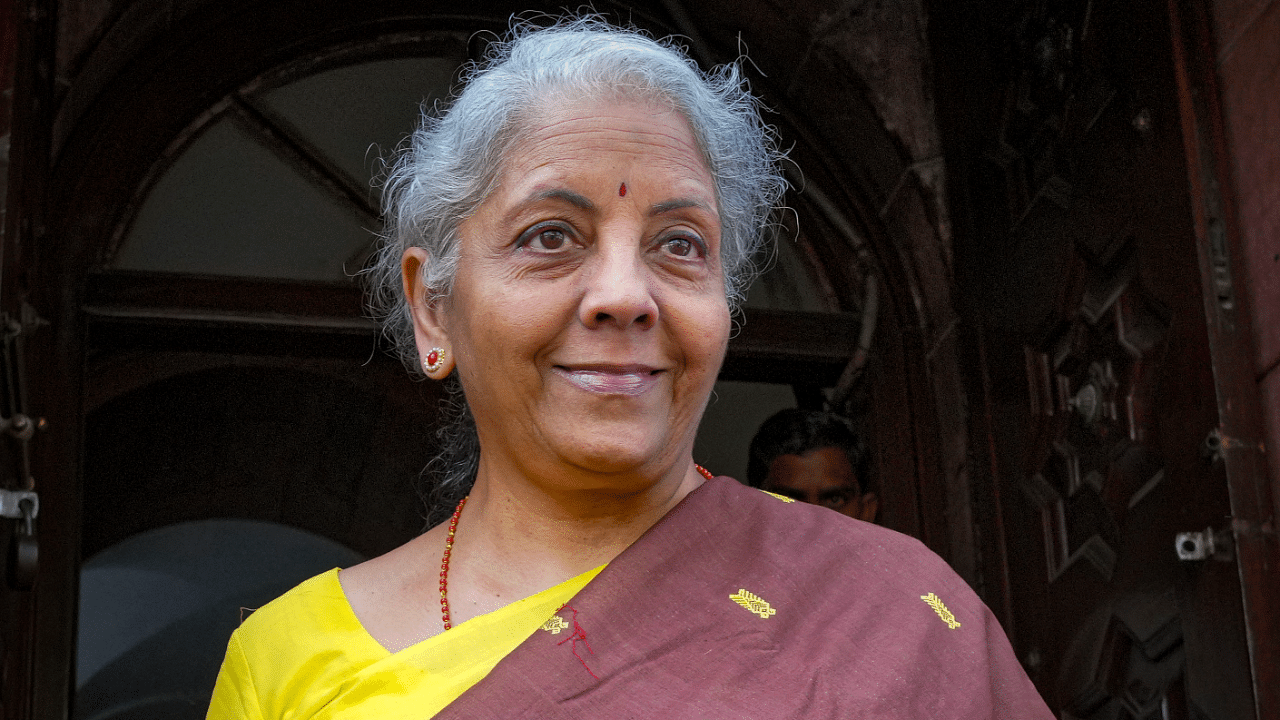

Finance Minister Nirmala Sitharaman on Saturday asked public sector banks (PSBs) to focus on risk management, diversification of deposits and asset base in order to better prepare themselves for challenges arising out of the banking crisis in the US and Europe.

In a meeting with heads of PSBs, Sitharaman underlined that PSBs must look at business models closely to identify stress points, including concentration risks and adverse exposures.

The meeting was called to review the performance of PSBs on various financial health parameters in light of the “current global financial scenario emanating from the failure of some international banks in the USA and Europe,” the finance ministry said.

Also read | Banking crisis in US and Europe won't have any material impact on Indian banks: Analysts

During the review meeting, an open discussion was held with the MDs and CEOs of PSBs on the global scenario comprising of the failure of Silicon Valley Bank (SVB) and Signature Bank (SB) in the US and the issues leading to the crisis in the Swiss banking giant Credit Suisse.

Sitharaman reviewed the exposure of PSBs to this developing and immediate external global financial stress from both the short and the long-term perspectives, the finance ministry said.

She advised PSBs to remain vigilant about the interest rate risks and regularly undertake stress tests.

During the meeting heads of PSBs claimed that “they are vigilant of developments in the global banking sector and are taking all possible steps to safeguard themselves from any potential financial shock,” according to an official statement released after the meeting.

“All the major financial parameters indicate stable and resilient PSBs with robust financial health,” it said.

Union Minister of State for Finance Bhagwat Kishanrao Karad and Secretary of the Department of Financial Services Vivek Joshi also attended the meeting.

During the course of discussion on the general banking scenario prevailing in the country, Sitharaman advised PSBs to focus on credit outreach in states where the credit off-take is lower than the national average, particularly in North-East and eastern parts of the country.