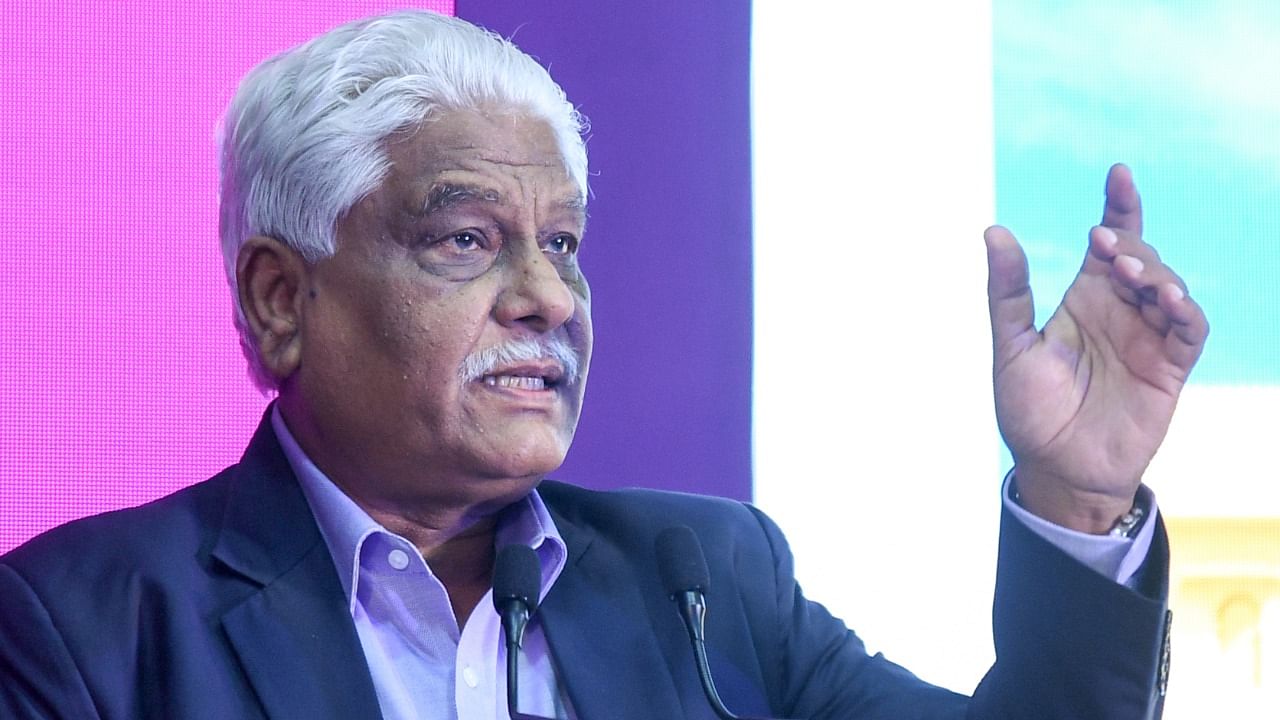

Investment firm Blackstone Inc-backed Nexus Malls filed draft papers for an initial public offering (IPO) with the market regulator Securities and Exchange Board of India (SEBI) last week, a first by an Indian retail real estate investment trust (REIT). In a conversation with DH's Shakshi Jain, Nexus Malls chief executive Dalip Sehgal shares the company's growth plans and recent trends in the industry. (Edited excerpts)

Tell us about the recent move to go public.

We have filed the DRHP (draft red herring prospectus) with Sebi last week. This will be India's first retail REIT IPO and (will) cover 17 assets under our management, including Select Citywalk in Delhi and the eight Forum malls we acquired from Prestige in March 2021. We anticipate listing sometime (in) early 2023.

Are your footfalls back to pre-pandemic levels?

Yeah. Our April-September number was about 97% compared to April-September 2019 which was pre-Covid. For October I think we would be at 107-108% at least, if not more.

I think the 97% in the first 6 months was on account of two or three things. One was that the cinema footfalls were not so great, especially in the North. I think the movies didn’t work well. A lot of footfall is generated by cinema. Whereas in the South the recovery is 130%. Colleges were also shut. We also get a fair bit of college crowd during the day, younger people coming into the food court to eat or just to browse, etc.

What is your outlook for mall development in India?

I think the outlook is extremely optimistic because there are only 97 A-grade malls in this country and they account for hardly 56 million square feet. And, if we - at 17 malls - can be the largest mall owners and operators, then the potential in a country of our size is significant.

The consumption story is very, very strong and compared to some of the other emerging markets like China, etc I think the preferred destination today is India. There is a very strong renewed interest in investing in the mall (space).

Do you see international brands taking over smaller Indian ones? What about the role of e-commerce?

Retail landscape is changing with the evolving consumers and their preferences. There are international brands which are shrinking and there are homegrown brands which are expanding. Yes, many international brands are making their foray into (the) Indian market but we don’t see this as a threat to smaller indigenous brands. We believe that the potential is huge for existing brands to further expand and (for) new brands to join the bandwagon.

To talk about e-commerce, this cannot be treated as a separate entity. The mall owners and retailers will need to come up with a strategy to work as a joint force and not compete with each other as there is a significant portion size of unorganised sector in India and siloed approach won’t work in those markets.

How do you see this competition between high streets and malls playing out in the coming times?

I don’t see why there is a competition. I think these are complementary. I think both will coexist. By and large depending on what kind of shopping they (customers) wish to do it is very clear in their minds. Let’s say it’s the weekend and you’re going out with your family, I think a mall is a preferred destination. On the other hand, a lady wanting to shop alone or (for) a specific kind of apparel may decide that I want to go to Dadar (a shopping neighbourhood in Mumbai) and buy stuff from there. That’s the way it always is and will be.

Going forward, do you see entertainment and F&B in malls having a larger share than shopping?

Today, the ratio probably between F&B (food and beverages) and entertainment is about 25-30% and the rest of it is shopping. It will change but not in a way that it will be 50-50. I think shopping will still be a very large component. But yes, F&B - the share has been going up every year. So, over a period of time F&B may gain 30-35% and the rest of it will still be shopping. Within that, categories may change - we find that electronics are becoming bigger and bigger every day, and fashion (too) will do well for sure. So, I think shopping would still remain three-fourths of the total.

Are you also looking beyond metros and tier -1 cities for growth?

Yes, we are. Our portfolio today is quite balanced between metros and non-metros. As long as the Indian consumption story is intact, be it in large cities or outside, we would certainly be open to investing there. I don’t think we have an agenda which says only tier-1 cities or only metros. Wherever there’s an opportunity and it is a commercially viable site - if the mall is very small we would give it a pass because it is very, very difficult to make a very small mall commercially viable. But if it is commercially viable we would go for it irrespective of where the location is.

A Knight Frank India report categorised 21% of Indian malls as ghost malls. How can the state of malls be improved?

The retail model of a ghost mall is different from a Grade-A mall. Ghost mall operators bid high on strata sale of commercial assets to retailers or individual investors. While this is a lucrative option for the mall operators to inject liquidity in overall cash flow, in the process, their overall control over the property starts coming down and this leads to lack of due diligence in maintaining basic mall infrastructure or driving more footfalls at the mall. These eventually leave the malls in a dilapidated state.

Shopping malls in India need to evolve as ‘destinations’ from being just shopping centres. The key is to study the customers and their shopping patterns closely and evolve in such a way that each of the malls has a distinct positioning of its own.

Have you observed any change in the demography of mall shoppers?

I think in terms of age and income profile, we are more or less where we were. In the last two years when the malls were open, it was the younger people who were a little more outgoing and - I think - not so scared...and gradually the others also started coming back. Similar is the case with cinema - first, it was the youngsters who came back but now we see a lot of family crowds on weekends at the theatres as well. So, I think in demographic terms we are back to pre-Covid levels.

Nexus Malls runs 17 malls across 13 major cities in India - both metros and tier-1 cities. How is the picture different for the two geographies?

Out of our 17 malls, nine are in metros or large cities. But the tier-1 & tier-2 malls have been showing equally good recovery, for example, Bhubaneshwar is growing at 150%. Similarly, Chandigarh mall is a huge part of our business and has been showing a steady recovery of 125%. It depends entirely on the catchment area and the business potential that the market has to offer.

So, while the business recovery has been prevalent both in metros and tier 1 cities, it's mainly the shopping categories that see a distinct difference of preference between the geos. For example, we are seeing pretty strong demand coming from metros for healthy lifestyle products. Consumers are more inclined towards purchasing health foods & supplements, fitness-related gadgets, personal hygiene products and immunity boosters.