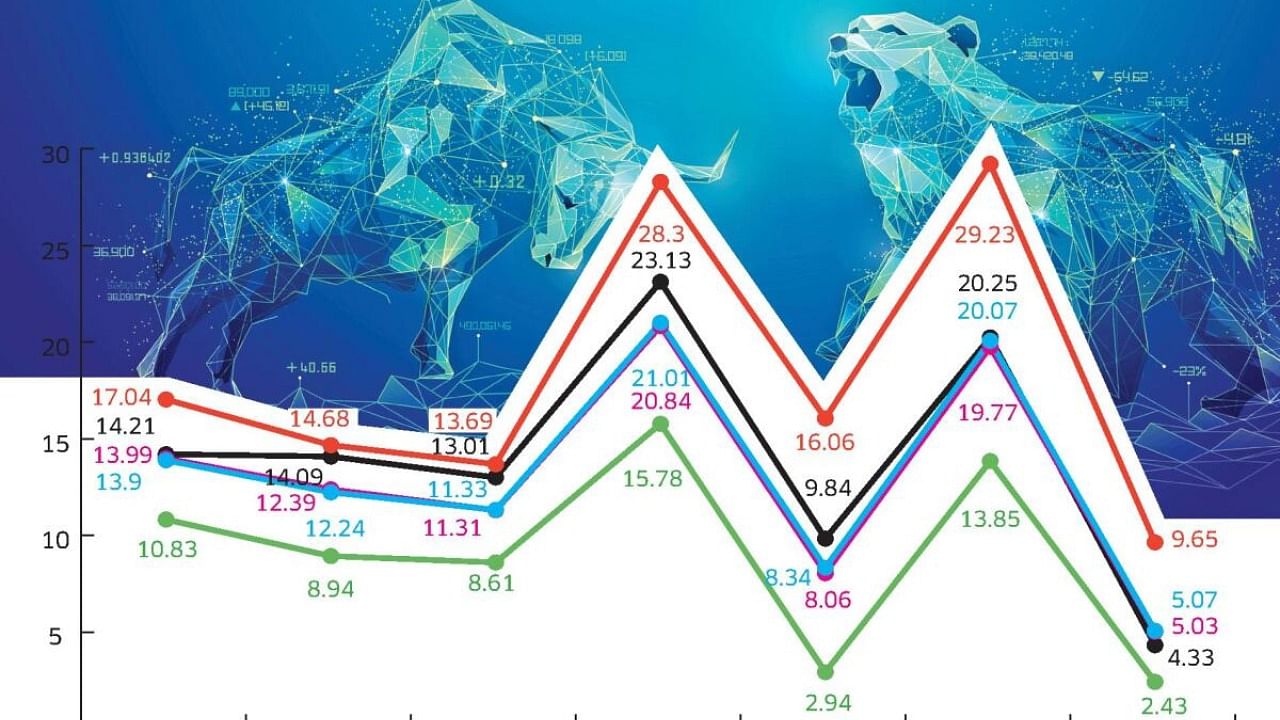

One of the most widely debated topics in the world of mutual funds has been active v/s passive investing. While both styles have their characteristics and outcomes, in the case of large-cap mutual funds, the debate has gained more momentum of late, as on quite a few occasions, it has been seen that many of the large-cap funds have underperformed their benchmark as can be seen in the compilation of 31 large-cap funds here.

Large-cap funds focus on investing in companies with large market capitalisations. Understanding the level of active management employed in such funds is vital for investors seeking potential outperformance and there are a few aspects to it:

* Since the target universe for investment for a large-cap fund is the smallest of the first 100 companies based on market capitalisation, many of the large-cap funds end up mimicking the indices.

* More importantly, the overlapping of portfolios is a bigger issue in large-cap funds, which inherently translates into low level of diversification for an investor.

The most crucial aspect of differentiation for a largecap fund is ‘active share’, which refers to the fund manager’s conviction and confidence in creating overweight and underweight positions on individual stocks in the fund.

Understanding Active Share

‘Active share’ is a measure that quantifies the level of differentiation between a mutual fund’s portfolio and its benchmark index. It indicates the proportion of a fund’s holdings that differ from the benchmark. A higher active share signifies greater divergence from the benchmark, suggesting a higher degree of active management to outperform the index. But this is a double-edged sword and can sometimes lead to underperformance.

Achieving a high active share can be challenging for a large-cap fund, which primarily invests in companies with significant market capitalisations. Analysts widely cover large-cap stocks and tend to have high market efficiency, making it difficult to find significant mis-pricings or deviations from the benchmark. However, skilled portfolio managers can still exploit opportunities and add value through active management.

Benefits of ‘active share’ in large-cap funds

Potential for alpha generation: ‘Active share’ enables portfolio managers to express their investment convictions by deviating from the benchmark index. In a large-cap fund, where market efficiency is relatively higher, a higher active share indicates the manager’s ability to uncover mispriced stocks and generate alpha.

Risk management and diversification: ‘Active share’ can help mitigate concentration risk in a large-cap fund. This diversification can reduce the fund’s exposure to specific risks and enhance risk-adjusted returns.

Differentiated investment approach: Large-cap funds with high ‘active share’ often have distinct investment philosophies and strategies and hence the potential for differentiated returns may find these funds appealing.

‘Active share’ is a valuable metric in evaluating a large-cap fund’s level of active management. While large-cap stocks present unique challenges for active managers, a high ‘active share’ can signify a manager’s ability to differentiate the portfolio from the benchmark and potentially generate alpha. However ‘active share’ is a relevant metric only if the fund is outperforming the benchmark, otherwise its better to stick to a passive index fund or a more flexible option like flexi-cap fund.

When evaluating active management in large-cap funds, investors should consider factors such as performance (net of fees) versus benchmark, investment philosophy, and volatility. Ultimately, an informed assessment of ‘active share’ and other relevant metrics highlighted above can help investors make well-informed decisions and align their investment strategies with their goals and risk tolerance.

Before investing, ask yourself and your advisor, “ How active is this active fund?”

(The writer is CIO and Founder,

Valtrust)