India will boost liquefied natural gas (LNG) imports from next year as private firm Swan Energy starts its floating terminal, raising the country's capacity to ship in the super chilled fuel by 12 per cent to 47.5 million tonnes per annum (mtpa).

New demand for LNG from India is expected to support Asian gas prices which rose to record highs earlier this year, partly aided by the transition from coal or oil to gas in developing countries.

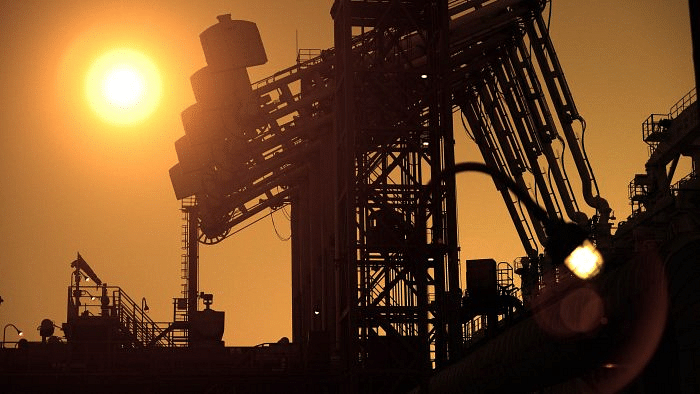

The 5-mtpa floating storage and regasification unit (FSRU), located at Jafrabad in western Gujarat state, will be commissioned in April, said P Sugavanam, director at Swan Energy and chairman of Swan LNG Ltd, which is developing the project.

The FSRU was initially expected to be commissioned in the first quarter of last year, but the pandemic and two cyclones have delayed construction of a breakwater, needed to make it an all weather facility, Sugavanam told Reuters on Wednesday.

"The breakwater should be completed by March," Sugavanam said, adding Ghana's Tema LNG is currently using the facility for storing LNG.

India, the world's fourth largest LNG importer, wants to raise the share of natural gas in its energy mix to 15% by 2030, from the current 6.2% to cut emissions.

Companies are investing billions of dollars in India to build gas infrastructure as Prime Minister Narendra Modi wants to raise the share of cleaner fuel in India's energy mix to 15% by 2030 from the current 6.2 per cent.

Swan is setting up a jetty and will build more tanks to eventually double the LNG import capacity, he said.

State-run gas importers Indian Oil Corp and Bharat Petroleum Corp, and exploration firm Oil and Natural Gas Corp have leased 1 mtpa capacity each at Swan's terminal.

ONGC earlier this year invited bids from potential suppliers for regular participation in its spot LNG buy tenders, according to a document obtained by Reuters.

Seven companies - Emirates National Oil Co (Singapore), Total Gas & Power, PTT International Trading, Vitol Asia, Gazprom Marketing & Trading Singapore, Mitsui & Co and Uniper Global Commodities - showed interest in participating in ONGC's tenders, a source familiar with the matter said.

Vitol and Mitsui declined comment while the others including ONGC did not reply to Reuters request for comment.

Swan Energy owns 63% of Swan LNG, while two entities of Gujarat state government together have a 26% share. Mitsui holds 11% and is also the technical partner on the project.