Interest rate-sensitive stocks gained on Friday after the Reserve Bank of India decided to leave the benchmark interest rate unchanged but maintained an accommodative stance.

"It was on the expected line with the RBI keeping rates unchanged and continuing with the accommodative stance. The extension of accommodative stance has cheered the market," Deepthi Mathew, Economist at Geojit Financial Services.

Shares of Bandhan Bank rose by 4.49 per cent, ICICI Bank gained 4.20 per cent, SBI was up 2.77 per cent, RBL Bank 2.29 per cent and Axis Bank 1.98 per cent. Indusind Bank also gained 1.96 per cent, Kotak Mahindra Bank rose by 1.34 per cent and HDFC Bank 0.59 per cent on BSE.

The BSE Bank index gained 2.14 per cent to close at 34,360.12.

"The outcome of the MPC meet on December 4 was largely on expected lines including the status quo on rates. The Committee's assurance to continue with the accommodative stance of monetary policy as long as necessary – for the current and next year - is welcome," Dhiraj Relli, MD &CEO, HDFC Securities.

Realty counters also witnessed buying, with DLF jumping 4 per cent, Sunteck Realty gained 2.52 per cent, Sobha Ltd climbed 1.57 per cent and Godrej Properties rose 1.44 per cent. The BSE realty index jumped 1 per cent to close at 2,239.03.

From the auto pack, Hero MotoCorp rose by 1.22 per cent, Maruti Suzuki India went up by 0.80 per cent, M&M by 0.62 per cent and Bajaj Auto 0.56 per cent.

The BSE auto index rose by 0.50 per cent and closed the day at 21,019.95.

The 30-share BSE benchmark index also rose 446.90 points to close at 45,079.55.

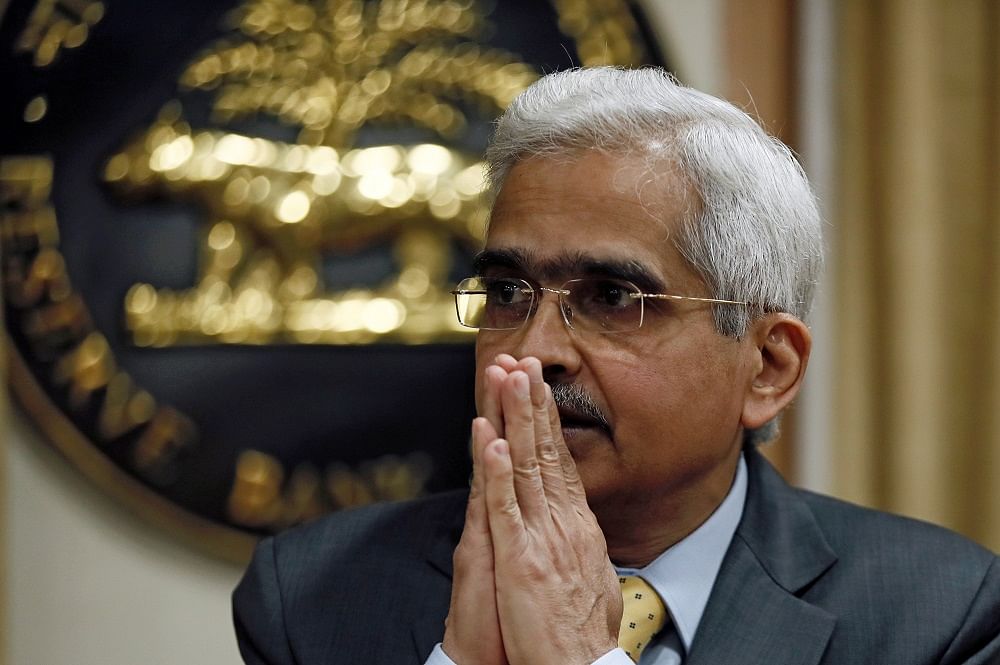

Concerned over elevated inflation, the RBI has decided to leave the benchmark interest rate unchanged at 4 per cent but maintained an accommodative stance, implying more rate cuts in the future if need arises to support the economy hit by the Covid-19 pandemic.

The benchmark repurchase (repo) rate has been left unchanged at 4 per cent.