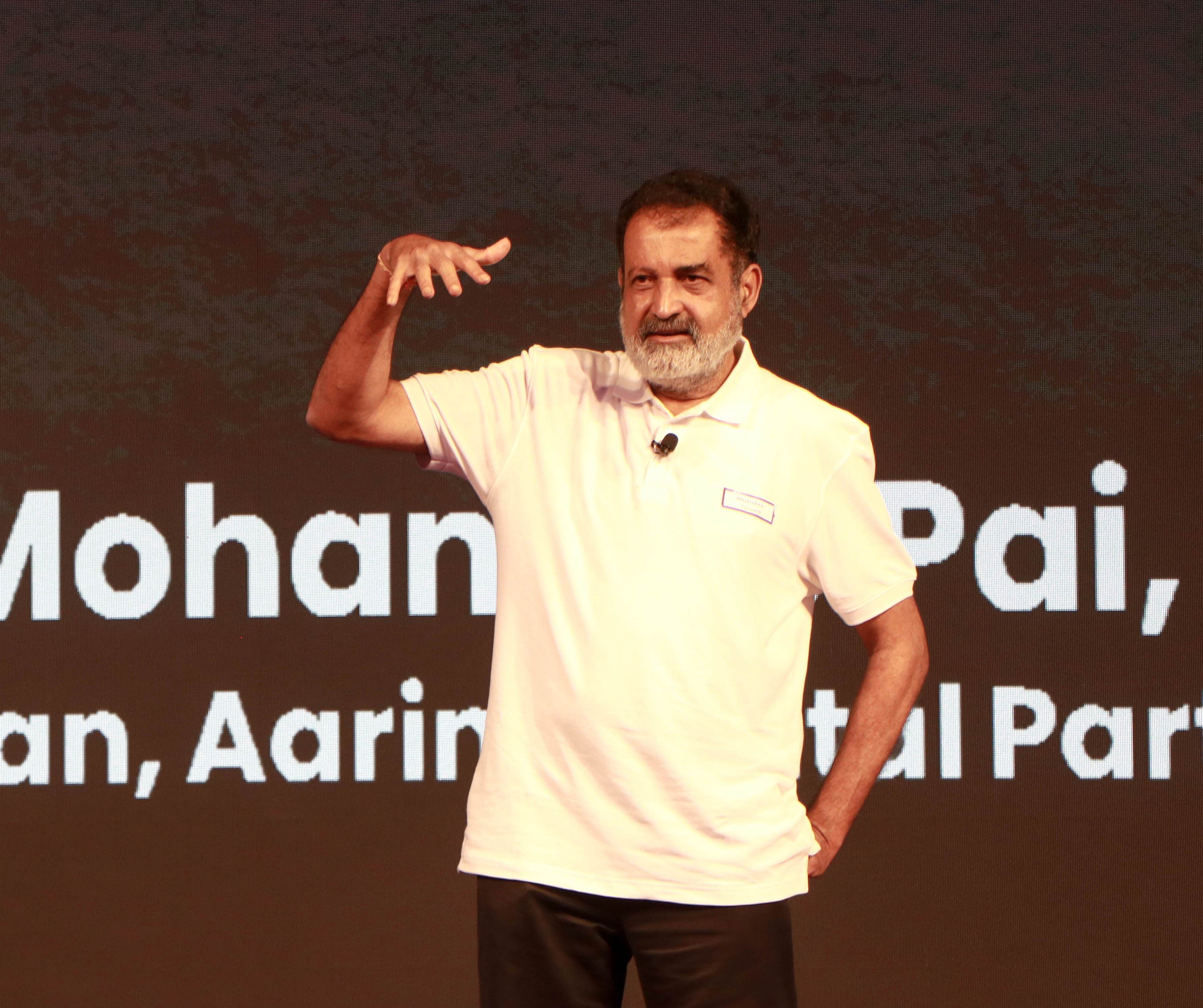

Industry veteran T V Mohandas Pai has said startups which do almost all their business in India and have all their employees here should resist any pressure from large investors to domicile outside, as the former Infosys director and chairman of Aarin Capital cited key lessons to be drawn from the collapse of Silicon Valley Bank.

Pai advised founders of India-centric startups "to be careful" and "not get carried away" by investors who force companies they fund, to domicile in the US and open bank accounts there as well. Pai said Silicon Valley Bank was a startup-friendly bank and its collapse is a "blow" to the startup ecosystem.

"Just how big is the blow, is something that we have to watch from startup to startup, and founder to founder," Pai told PTI.

He added that the exposure of Indian startup ecosystem to Silicon Valley Bank is not too high.

Pai has a word of advice for entrepreneurs and founders -- startups whose businesses are centered around India and have very little to do with US should operate as India-headquartered company, he said.

"If all your business and people are in India, there is no need for you to open a foreign currency account outside and get domiciled outside. So resist the pressure from investors to have domicile outside, for a startup which does almost all its business in India," Pai said.

Silicon Valley Bank's abrupt collapse -- that unfolded in a matter of hours earlier this week -- has left Silicon Valley entrepreneurs unnerved and jittery. Federal Deposit Insurance Corporation on Friday seized the assets of Silicon Valley Bank -- the action reportedly in the middle of the business day highlighted the severity of the situation.

Silicon Valley Bank was deeply entrenched in the tech startup scene and the default bank for many high-flying startups; its abrupt fall marks one of the largest bank failures since the 2008 global financial crisis.

The bank failed after clients -- many of them venture capital firms and VC-backed companies that the bank had cultivated over time -- began pulling out their deposits, creating a run on the bank (among the biggest US bank runs in more than a decade). Bank runs occur when customers or investors gripped by panic start withdrawing their money, causing the bank to be incapable of paying its obligations as they come due.

Many venture capital firms reportedly advised portfolio companies to pull out cash as a precaution. Reports suggest that startup founders in the US are concerned about whether they'll even be able to make payroll, and some entrepreneurs whose funds are frozen at the bank are said to be turning to loans to tide over the situation.

The collapse of Silicon Valley Bank, a startup-friendly bank, is a "blow" to many, including young companies, according to Pai.

"Those who have their money deposited in the bank and are not able to get it out will face uncertainty and liquidity problems...you had a very startup-friendly bank, which has gone bust," he noted.

Silicon Valley Bank was a "big catalyst" for the startup ecosystem even globally.

"They were also a fairly big investor in early startups. They used to deploy capital and they used to be very friendly, they understood the risk. They had considerable expertise in startups. That going away, is a big blow," Pai said.

Back home, the Reserve Bank of India should work more closely with startup ecosystem to make it easier for Indian ventures to do global business, he pointed out.

"Today, there is great amount of pain for Indian startups to get money from overseas into India, and send money from India, overseas...RBI should also study why Indian startups go abroad to do business in dollars...they make it very hard for money to come in, very hard to send money out," Pai said.

State Bank of India (SBI) has opened specialised branch for startups, Pai said and hoped that many more banks open startup branches to help startups do foreign exchange transactions.

"The lesson for India is simple, make things easy for Indian startups to operate here so they don't have to go overseas, open a bank account to do overseas transactions, because our banks are well-regulated. Follow the SBI model of having a startup branch which will concentrate and give better services to startups," Pai said and added regulations that are not startup-friendly and involve too documentation should be changed.