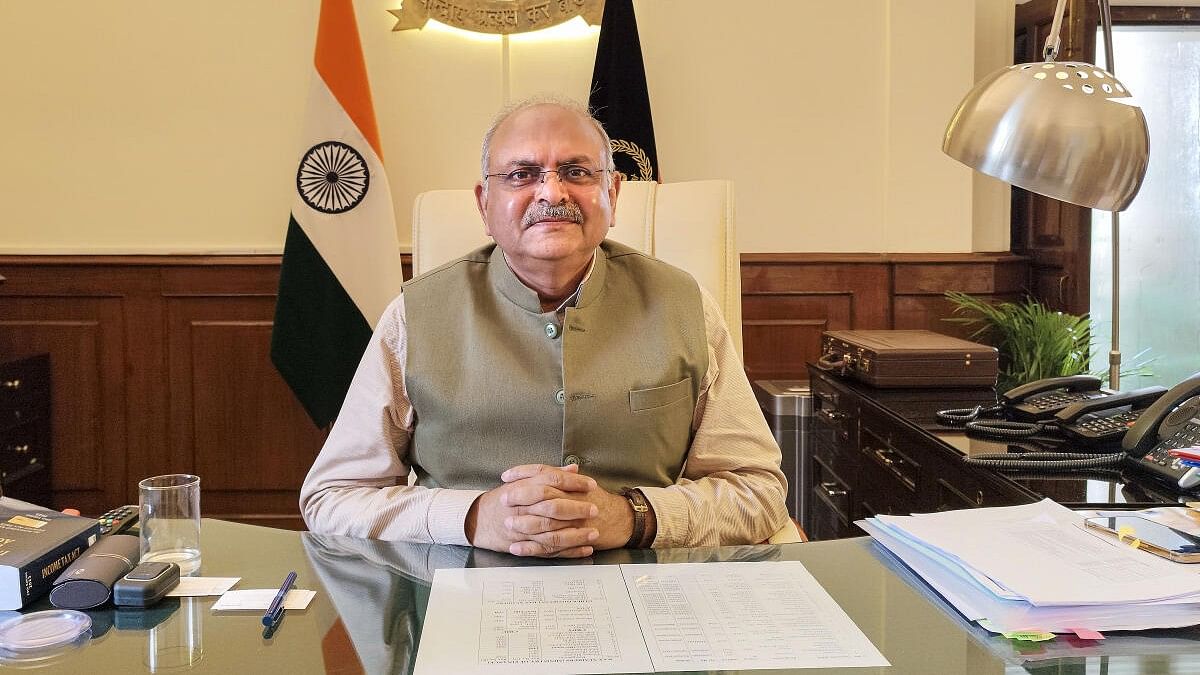

CBDT Chairman Ravi Agrawal.

Credit: PTI Photo

New Delhi: The budget announcement about a comprehensive review of the Income Tax Act, 1961, is an attempt to make the "bulky" law "simpler" to understand and comfortable to use for taxpayers along with aligning new technology processes with it, CBDT Chairman Ravi Agrawal has said.

The Act that started its journey in 1922 contains 298 sections, 23 chapters and other provisions in its current form of 1961.

Speaking to PTI during a post-budget interview on Wednesday, Agrawal said the Act has seen "redundancies" over a period of time making it "thick and bulky."

"The taxpayers also feel that the Act is not so simple, as it ought to be...it is cumbersome...so the attempt is if we can make this Act simpler, simpler to comprehend, simpler in terms of language, simpler in terms of presentation, then that hitch of the taxpayer to actually not see the Act and take the help of a tax practitioner or someone (maybe eased)..."

"We are working towards how can we make it (Income Tax Act) simple so that the taxpayer feels comfortable seeing the provisions himself or herself and that it is more user friendly," the Central Board of Direct Taxes (CBDT) head said.

It is also important to review the law as technology has become an integral part of tax administration and "we have to see where the gaps are and how we actually can align technology with the provisions of the Act," Agrawal said.

We are looking to undertake further improvements (in the law), he added.

Union Finance Minister Nirmala Sitharaman, while presenting the Union Budget for 2024-25 on Tuesday, announced a "comprehensive" review of the Income Tax Act of 1961.

"The purpose is to make the Act concise, lucid, easy to read and understand. This will reduce disputes and litigation, thereby providing tax certainty to the taxpayers. It will also bring down the demand embroiled in litigation. It is proposed to be completed in six months," she said.

Sitharaman added that a beginning was being made in the Finance Bill by simplifying the tax regime for charities, TDS rate structure, provisions for reassessment, search provisions and capital gains taxation.

Asked about the budget proposal of granting immunity from penalty and prosecution to a 'benamidar' (in whose name a benami asset is standing) under the Benami Transactions Prohibition Act, the CBDT chief said this was aimed to make the act "effective".

The minister said the move was intended to "improve conviction" under this law, which was enacted in 1988 but implemented in November 2016 by the Modi government.

A convict under this law can be sentenced to a rigorous imprisonment of up to seven years and a fine of up to 25 per cent of the fair market value of the property.

Benami properties are those in which the real beneficiary is not the one in whose name the property has been purchased.

Agrawal also said that the Income Tax Department has completed about 6.5 lakh assessment cases and about 2 lakh appeals under the faceless assessment regime that was launched by the government in 2019-20.