With the stock markets showing signs of fatigue on the back of valuations being way ahead of fundamentals, interest rates on bank FDs and bonds being subdued and gold going nowhere, investors are confused and concerned. What investment options do they have as they step into the next year? Let us try to decode the different asset classes, see how they have performed in the last few years and what does circa 2022 hold for investors.

Equity as an asset class

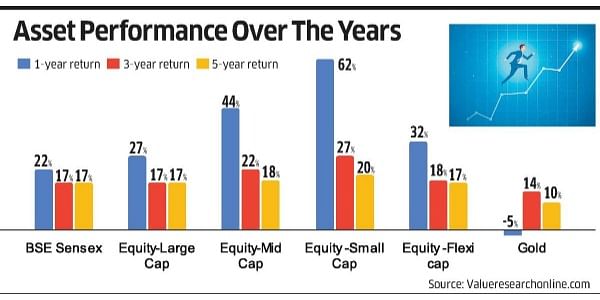

The Sensex had a great year with scores of companies raising money through IPOs, giving a return of 22 per cent. Equity mutual funds too did very well with small cap companies giving a whopping 62 per cent return compared to 27 per cent return of large cap companies.

Investing in stocks has caught on with investors directly as reflected in the multi-fold increase in opening of demat/trading accounts in the last one year or so. Since investing in equity requires lot of time and skill and since there are concerns about Omicron impacting stock market returns in the next few months, it would be a better idea to invest in equity mutual funds either by investing a lumpsum amount or through an SIP (Systematic Investment Plan).

Debt as an asset class

2021 was not the best year for debt mutual funds with most of them delivering between 3-4 per cent barring credit risk funds which gave a return of 8.77 per cent. Credit risk funds are mutual funds that invest in bonds rated “AA” and below, carry a high degree of credit or default risk. This may not be an ideal investment option for investors with a low-risk appetite.

With inflation going up, it will be sooner rather than later that RBI will start increasing the benchmark rates and the consensus is that the interest rates may go up by 100 basis points in 2022. And that’s not good news for investors willing to invest in debt mutual funds since their investment is likely to give a negative return. It would be better to stay away from debt mutual funds in 2022.

For investors, who cannot stomach the risks in debt mutual funds, there are many post office saving schemes which look attractive as some schemes offer higher interest rates vis-a-vis bank deposits. Some of them also qualify for tax benefits.

Gold as an Asset Class

Gold had a forgettable year, and it was the only asset class which gave a negative return during 2021. However, gold has always been popular with Indian households as an investment option since it is used as a status symbol and normally held in the form of ornaments. Gold prices have been hovering around $1,800 per troy ounce throughout 2021 but is expected to do well in 2022.

While gold is considered an essential item on every individual investors portfolio, experts advise against holding over 10 per cent of it in the total mix. The ideal investment option would be to invest in a Gold ETF for which you need a demat account or the sovereign gold bond scheme (SGB) 2021-22 which are issued in tranches with the next one i.e Series IX slated for subscription from January 10, 2022. The advantage with SGB is that you get an additional 2.50 per cent interest every year during its tenure of 8 years, as also the exemption from long term capital gains if you hold them till maturity.

Cryptocurrency

With bitcoin catching the fancy of investors, especially the young Indians, investing in cryptos is a hot topic now.

Government has also clarified that it would not ban cryptocurrency in India but would rather recognize it as an asset and not as a currency. Since there is no clarity on capital gains & the tax aspects, it would be prudent to wait & watch.

The golden rule however is to diversify your portfolio across many asset classes, a strategy that has been so nicely explained by the American economist Harry Markowitz in his modern portfolio theory.

(Author is a CFA & a former banker. Currently he teaches at Manipal Academy of BFSI, Bengaluru)

Watch latest videos by DH here: