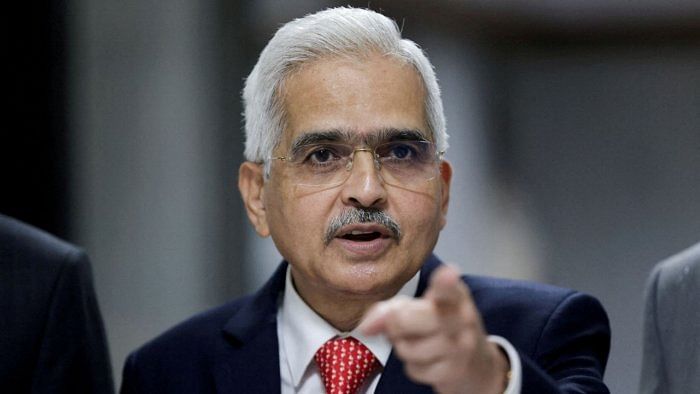

Last week, announcing the bi-monthly monetary policy, the Reserve Bank of India (RBI) governor, Shakthikanta Das laid stress on withdrawing accommodation to reduce the liquidity in the system and rein in inflation. However, the apex bank’s effort to mop up excess liquidity using variable rate reverse repo (VRRR) auctions have drawn a tepid response from the banks so far. While theRBI targeted bringing in Rs 4.5 lakh crore from the last four rounds of VRRR auctions, it managed to get barely Rs 1.52 crore.

The return of Rs 2,000 denomination banknotes, that RBI is withdrawing from circulation, has added to the liquidity of the banks. Das mentioned that 50% of the notes (Rs 1.8 lakh crore) have returned, 85% of which has come as deposits. The surplus presently with the banks is estimated to be Rs 2.26 lakh crore. More of the Rs 2,000 banknotes are expected to return to the banks until September. However, for now, the banks seem eager to cling to the liquidity in anticipation of the outflow by way of advance tax payments around mid-June. This raises questions about the effectiveness of VRRR auctions in moping out liquidity from the system to control inflation.

Also Read | RBI right again to peg interest rates

In VRRR auctions banks give very short-term loans to RBI at a fixed rate and tenure, effectively reducing their own supply of money. Das in his speech was clear that while RBI does not want to tinker with repo rate just yet and is steering clear of hampering GDP growth potential, it was aware of the need to still bring the inflation rate to target level and is looking to do so by withdrawing liquidity from the system through other means.

“Liquidity control is not a one-off action. It’s a continuous process,” former deputy governor of RBI, R Gandhi, pointed out to DH. On the other hand, rate action is a one-off measure. Liquidity action and rate action may not necessarily work in the same direction, he added.

For their part, the banks see the present liquidity as a temporary situation and expect the tax outflow to take care of a good part of it in the next two weeks. For the banks, the return of the banknotes, that are being retired, presents an opportunity at a time when they have been struggling with matching the credit off-take with regular deposit inflows not keeping up. Before this, the banks took the Hobson’s choice of raising funds with bonds that come with high price tags, limiting the scope of deploying the avenue.

But RBI will pursue the withdrawal of liquidity for a while now. “VRRR will continue as long as there is surplus liquidity in the system, which is presently over Rs 2 lakh crore. The response was tepid as banks were keen to know what the RBI had to say in its policy. Otherwise, the response would have been better,” explained Madan Sabnavis, chief economist at Bank of Baroda. He estimated that the VRRR auctions will continue for the next few weeks. The tenure is important as banks are not keen to lock their funds in for long. Ideally, 2-4 days work better, he added.

“Given the uncertainty in the global economy and inflation expectations from El Nino in India, VRRR irons out the skewed liquidity distribution among individual banks and temporary liquidity resulting from Rs 2,000 banknotes returning,” says Dr Nirakar Pradhan, PREMIA India CEO.

However, the VRRR auctions will have to compete with government securities (G-Sec) presently giving an yield of around 7% and the treasury bills (T-Bills) with yield ranging between 6.6 and 7%. A senior official of Bank of India, on condition of anonymity, pointed out that at an annual rate of 6.49 VRRRs do not seem so enticing, though for a far shorter period. And there lies the challenge for RBI, as to how much it can flex its VRRR muscle to shrink liquidity and bring inflation to the targeted level.