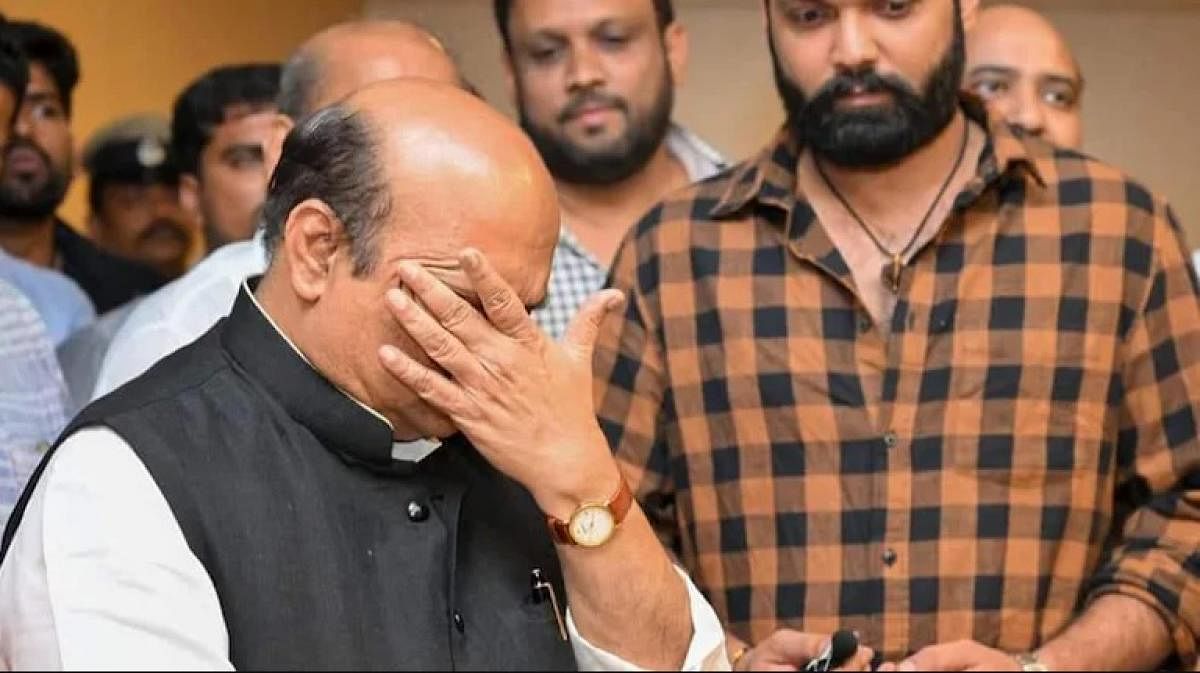

Chief minister Basavaraj Bommai, moved to tears after watching the emotional dog film ‘777 Charlie’, declared the Rakshit Shetty-starrer tax free recently. “The film spreads awareness on the ill effects of in-breeding among dogs, highlights the nuances of animal violence and champions the cause of adoption of stray dogs,” the chief minister had said.

A couple of months back, the politically-charged Hindi film ‘Kashmir Files’ was made tax free by several states. Responding to the developments, Kannada filmmaker Mansore (‘Act 1978’ and ‘Nathicharami’), known to make social dramas, wrote a letter to the CM saying this is a positive development, but it shouldn’t be restricted to one-off films.

He spoke to Showtime about how all films that carry socially relevant concerns must be exempted from tax. Excerpts:

When GST was introduced, how did the Kannada film industry respond?

Earlier, Kannada films, especially those shot in Karnataka, were declared tax free. Once the centre rolled out the GST regime in 2017, Kannada films lost the entertainment tax exemption. We were told that the states didn’t have the power to exempt tax and the process was centralised. Only when ‘Kashmir Files’ went tax-free in many centres recently did we realise that the states had the authority to take a call on this aspect.

Does ‘777 Charlie’ declared tax free give hope to filmmakers like you?

I was very happy for ‘777 Charlie’. If the government can go back to its old rule and consider films made in Karnataka and those that are cause based, then it will inspire filmmakers who regularly make films on such subjects. This is a request.

Who benefits when a film is made tax free?

The producer or director don’t directly benefit from this move. But it helps single screens and multiplexes. Right now, people are slightly detached from theatres, watching only the big-scale films on the big screen and viewing the smaller films on OTT platforms. The ticket prices have gone up. So if the entertainment tax isn’t imposed, people will show interest to come to theatres and it will help cinema halls to sustain.

The streaming sites ask for a film’s overall theatrical performance and the buzz it created when it was out in theatres.

So if a film enjoys success, it helps the producer to convince an OTT platform about his product and sell his film for a good rate.

The process

Before the GST era, the deputy director at the Information Department would scrutinise films and those that spread hate, and promoted extreme violence and remakes weren’t considered, says Mansore.

Which films get picked?

Films with inspiring or socially relevant subjects hold a chance to be exempted from entertainment tax, as per the general rule from the government. The entertainment tax on the ticket price is waived when a film is made tax free.

In the beginning, tickets were subject to 28 per cent GST under the regime in 2017. Later, there was a split: tickets priced at less than Rs 100 had 12 per cent GST and those costing 100 or more had 18 per cent GST.

Also, when a film is made tax free, only the SGST (state) aspect is removed while the CGST (centre) stays. So based on the ticket price, around 6-9 per cent is exempted.