The early onset of summer and increased economic activities with the waning of the Covid-19 pandemic have resulted in a sudden surge in demand for electricity across the country. But as supply could not catch up with growing demand, more than dozen states, including Punjab, Tamil Nadu, Andhra Pradesh, Telangana, Odisha and Bihar, resorted to power cuts, ranging from two hours to eight hours. Punjab alone witnessed a 40% spurt in demand in comparison to the corresponding period last year, according to the state’s power minister Harbhajan Singh, who attributed it to soaring temperatures. Not only in Punjab, demand for power grew quickly in several other states across the country.

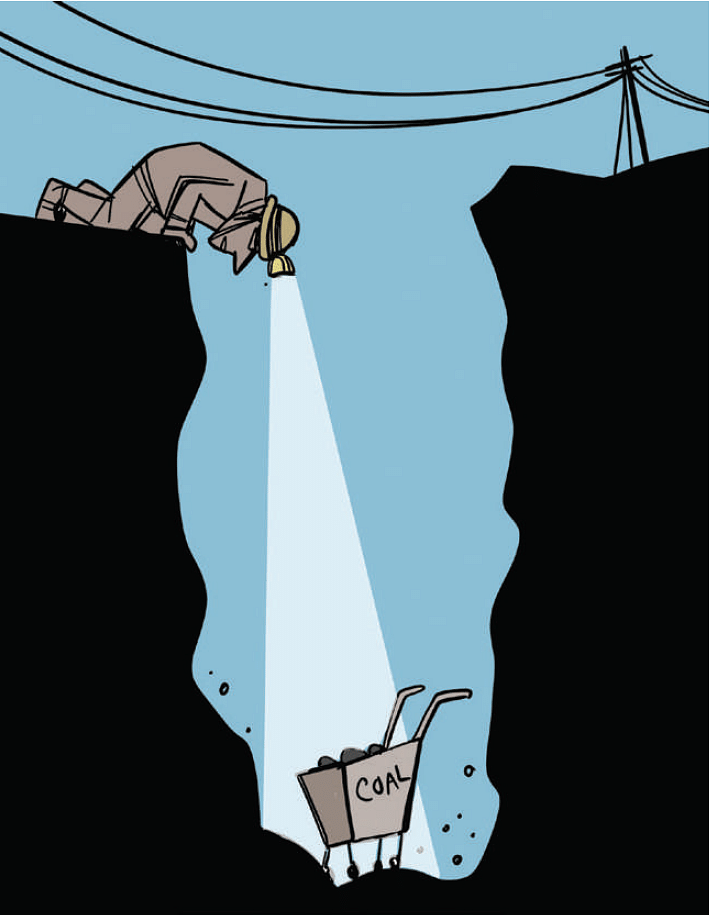

With the thermal power plants supplying over 70% of the country’s electricity, the low stock of coal and its short supply proved to be a big hurdle in meeting the growing demand, leading to long hours of outages in several states. Many thermal power plants already had low stock. Heavy rain in coal mining areas during last year’s monsoon season hit production and supply. When demand for electricity increased, the states were reluctant to purchase coal from the international market due to soaring prices, adding to the pressure on domestic mines to supply to meet the demand of the thermal power plants. International prices for coal have been hitting record highs since 2021, mainly as the industrial demand went up as shutdowns imposed to contain the spread of the Covid-19 pandemic eased. What stymied India’s coal imports is the disruption in the supply chain in the wake of the Russia-Ukraine conflict, which triggered energy insecurity and hence raised demand for coal in Europe.

Power consumption in India in the last two months alone jumped by almost 17%, compared to the same period in 2019. The global coal prices increased by 40% at the same time, and India’s imports fell to a two-year low. As per the Central Electricity Authority report on coal stock on May 5, out of 173 thermal power plants, 107 plants have critically low stock of coal.

Union Power Minister R K Singh, however, says that the problem of outages was not caused by shortage of coal but because of non-payment of dues to Coal India Limited (CIL), delay in lifting coal, and “improper planning” by the states. According to the Ministry of Power, state generation companies collectively owe Rs 7,918 crore to CIL, a major domestic supplier of coal.

The states, too, sought to turn the table on the Centre, blaming it for low coal supply. But Coal Minister Pralhad Joshi says that CIL increased supplies to thermal power stations by 14.2% in the first half of April 2022, compared to the same period last year. Coal generation has gone up to 1.64 million tonnes (MTs) per day compared to 1.43 MTs in 2021, adds Joshi.

Demand for power has been increasing year after year. It increased to 124.2 billion units per month in 2021 from 106.6 BU per month in 2019. In 2022, the demand has further increased to 132 BU.

“Electricity distribution is a purely state issue. There is electricity available in power exchange and sufficient coal stock available. But due to poor financial health of state electricity distribution companies and state power generating companies, states are not able to buy it,” says energy expert Narender Taneja.

The data available with the Ministry of Power shows that the total outstanding dues owed by the state electricity distribution companies (DISCOMS) to power producers went up from 1,05,029 crore in April 2021 to Rs 1,23,244 crore in April 2022.

The depleting stocks of coal in the thermal power plants triggered fears of blackouts in several states across the country. Nitin Raut, Energy Minister of Maharashtra, on April 15 warned of an impending power crisis. In Delhi, Chief Minister Arvind Kejriwal’s power minister Satyender Jain on April 29 warned about the possibility of disruption in power supply to hospitals, Delhi Metro and other critical infrastructure in the national capital territory.

Indian Railways cancelled over 1,000 trips of 40 trains to give priority to transportation of coal to power plants across the country. Anticipating 20% more demand for electricity in the coming days, the Union Ministry of Power has ordered all power plants running on imported coal to operate at full capacity. The ministry also directed all states and generating companies running on domestic coal to import at least 10% of their requirement of coal for blending.

Also Read | Power crisis could have been averted

“Power sector is a capital-intensive sector. We should run the sector based on a commercially viable system. Mindless freebies will kill the sector and will harm people and the country’s economic growth,” says Taneja.

In 2015-16, the Centre announced an ambitious target of installing 175 GW of renewable energy, excluding large hydro plants, by 2022. However, the country managed to install around 53 GW by March 2022.

“Setting up more thermal power plants or reviving defunct plants will help generate more power. Establishing more nuclear power plants will also help to produce more clean energy as well,” Vivek Jain, director at India Ratings Research, said.

India’s peak power demand touched 207 GW on April 29. The daily average shortage was 4,701 MW in April. The total electricity shortage in the country hit 623 million units in April, surpassing that in March. The Ministry of Power estimated that the electricity demand would reach about 215-220 GW in May-June.

“More investment by the private sector in coal mining will help improve production. Clearing dues for private power utilities and state-run companies are most important for their functioning,” said Jain.

Though the government auctioned coal mines for commercial mining, they will start operation only by 2025. The crisis also hit the ambitious programme of Prime Minister Narendra Modi’s government to provide electricity to all. It also cast a shadow over economic recovery, too. The state governments of Haryana and Rajasthan have already curtailed power supply to industrial units in the states.

Joshi, however, sought to dismiss apprehensions about large-scale blackouts, saying that coal companies were dispatching almost 2 million tonnes (MT) of fossil fuel every day to the power sector by various modes, including railways, roadways and rail-cum-road (RCR) mode. Additionally, 16.7 MT coal has been offered to power generation companies with an option to lift this quantity in RCR mode to augment stock, he added.