The Indian financial system is crumbling. The entire financial structure and various financial institutions - public and private sector banks, Non-Banking Financial Companies (NBFCs), Housing Finance Companies (HFCs), Co-operative banks, have become fragile, fragmented and prone to disasters.

During last 4 years, huge frauds and financial misdemeanours have been unearthed in public sector banks – Rs 11,400 crore scam of Punjab National Bank-Nirav Modi and Mehul Choksi cases, ICICI bank fraud of Rs 1,875 crore pertaining to Videocon group involving Chanda Kochhar, former CEO of ICICI, now under the scanner of CBI/ED.

The bust up of Infrastructure Leasing and Financial Services (IL&FS) in 2018 which was a gem among the NBFCs and a darling for the lenders, led to the debacle of the NBFC sector itself due to contagion effect. The group has borrowings of nearly Rs 91,000 crore, out of which bank loans are Rs 57,000 crore - 70% of which from PSU banks.

There are 9,659 NBFCs registered with the RBI as on March 31, 2019. The NBFC sector’s gross toxic loans has shot up from 5.8% in 2017-18 to 6.6% in 2018-19.

Next was Dewan Housing Finance Limited (DHFL) from the HFC sector which defaulted on its Rs 1,000 crore payment obligation. DHFL has a housing loan outstanding of over Rs 1 lakh crore, deposit base of Rs 10,000 crore which is the real concern.

The central government now moved the regulation of all the HFCs from NHB to the ambit of RBI. Hence, frauds and scams are pervasive across sectors, irrespective of who controls and supervises the institutions as there is no substitute for integrity.

In the last 11 years, around 50,000 cases of fraud have affected the banks involving staggering Rs 2 lakh crore.

What happened and how?

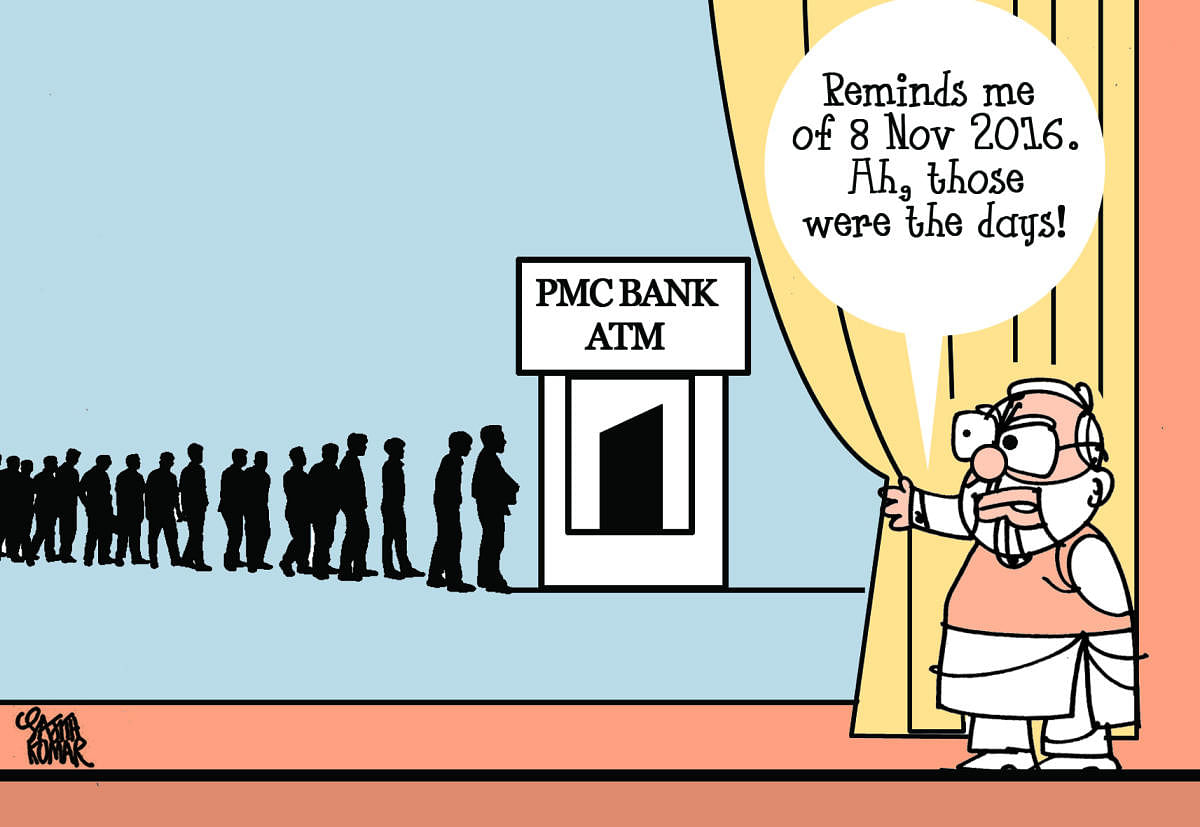

The Punjab and Maharashtra Co-operative Bank (PMCB), a popular Urban Co-operative Bank (UCB) of Maharashtra and among the top 10 UCBs in India, came close to shutting down as it put its gullible depositors in deep peril.

The bank has a legacy of more than three decades in serving to the cause of financial requirements of small and middle class - traders, small farmers, women worker, teachers, MSMEs, small time vendors - true to the co-operative charter of ‘each for all and all for one’.

The bank got into serious issues with its unscrupulous and corrupt lending to a ‘shady’ builder - Housing Development Infrastructure Limited (HDIL) to the tune of Rs 6,226 crore - 73% of its loan book size!

Managing Director of PMC bank Joy Thomas has brought sorrow to the depositors. Total deposits of the bank were at Rs 11,617 crore as on March 31, 2019.

Post whistle-blowing by a bank employee, the MD of PMC confessed on the misdeeds of bad lending to HDIL vide his letter of September 21, 2019 to the RBI, fudging of NPA position of HDIL, falsification of records, creating 21,049 dummy accounts to hide HDIL NPAs - to “protect reputation of the bank”.

The loan disbursements to HDIL - already an NPA account with PMCB, was utilised to pay off default amounts to Bank of India (which has filed bankruptcy proceedings against HDIL).

RBI surprisingly moved swiftly, appointed an administrator to the bank and filed FIR with the police against PMCB chairman - Waryam Singh (close to the promoters of HDIL/DHFL), suspended MD, HDIL and its main promoters. The main promoters and suspended MD have been arrested.

Fallout effects:

A scam of this magnitude has happened with the connivance of all concerned.

PMCB’s top management, its Board, its statutory and internal auditors, rating agencies and the RBI are responsible and accountable for the collapse of the bank - in varying degrees.

The internal/statutory auditors appointed by the PMCB with the ‘express approval’ from its Board has failed to detect the unscrupulous practices, suspicious transactions, dummy account operations, non-adherence to standard operating systems and procedures etc.

The suspended MD is now crying foul on the auditors for “superficially auditing” the books due to “time constraint”.

It may be a long drawn affair for the depositors even to get Rs 1 lakh from the Deposit Insurance and Credit Guarantee Corporation (DICGC).

The episode is a grim reminder of the Madhavpura Mercantile Co-operative bank (Gujarat-based) fiasco involving the infamous stock broker Ketan Parekh during 2012 where still many depositors have not received even Rs 1 lakh from the DICGC. RBI has since increased the withdrawal limit to Rs 25,000 period cap of six months to the PMCB depositors and account holders.

Unlike PSBs, the co-operative banks come under dual control and regulation of both RBI and the Registrar of Co-operative Societies (RCS) of the state governments. Here, the RCS failure to check and detect fraudulent/suspicious transactions has proved very costly and that of RBI as a referee/with vicarious responsibility.

Political nexus

Co-operative banks have political nexus. Certain powerful clients make use of the co-operative banks as a conduit to raise huge money by way of loans to fund their legal/illegal business interests - real estate, sugar industries etc. The very structure of co-operative banks is a toxic recipe for disaster.

The big and the mighty shareholders/borrowers take advantage of the weak systems and procedures of the co-operative banks as the borrowers do not come under the direct radar/surveillance of the RBI. Big sharks use the deposit route for conversion of unaccounted cash: tainted money for money laundering.

The RBI has also failed. The central bank deputes its inspecting team periodically to all the PSBs and UCBs, select NBFCs and HFCs. How did the RBI inspectors fail to detect the fraudulent and sham transactions of HDIL - involving Rs 6,226 crore to a single party?

The RBI should immediately explore possibility of PMCB’s merger with a bank having synergy.

The government should appoint an expert committee to look into all the possible lacunae in the banking system and make far-reaching recommendations to overhaul the financial structure.

(The writer is a Bengaluru-based banker)