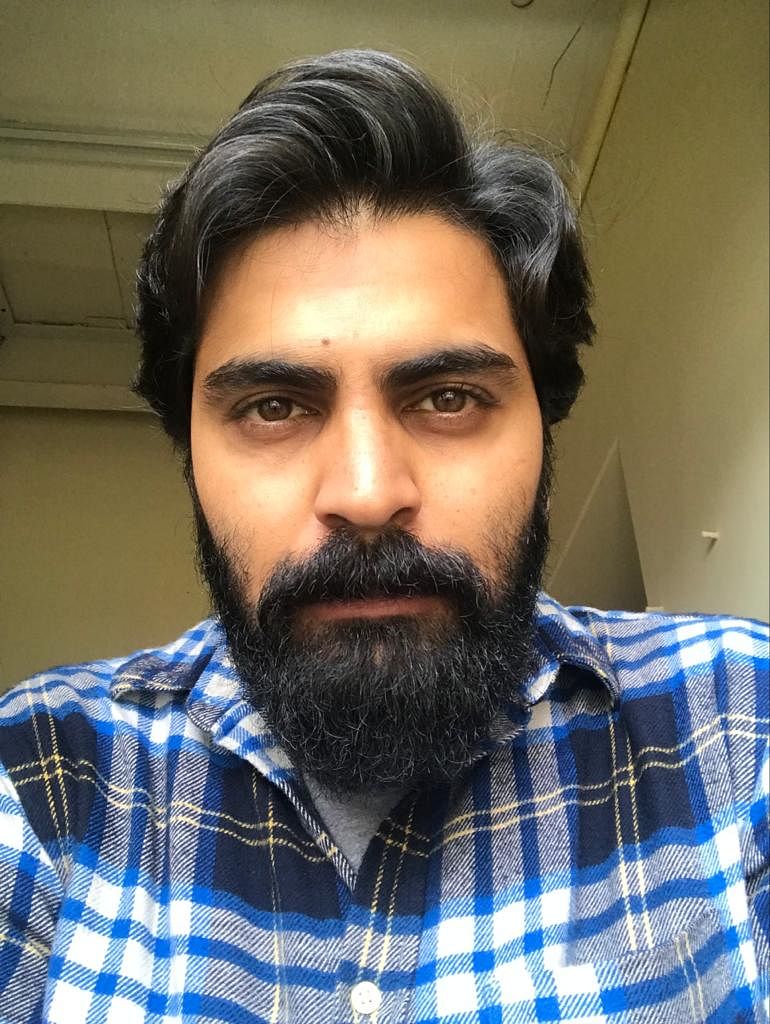

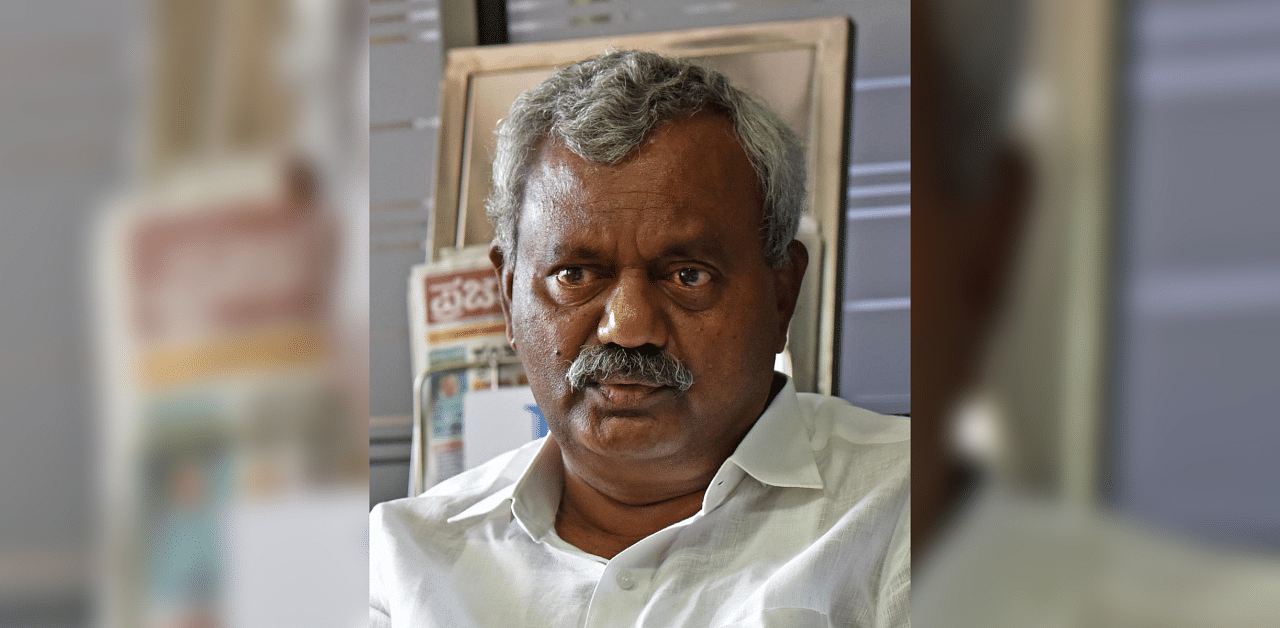

Cooperation Minister ST Somashekhar on Tuesday moved to act against sugar factories that have defaulted on loans borrowed from cooperative banks.

At a meeting to review the district cooperative central (DCC) banks, Somashekhar found that 119 sugar factories had outstanding loans worth Rs 5,229 crore of which Rs 4,864 crore was active.

“But loans amounting to Rs 365 crore have become non-performing assets (NPA). I have sought a comprehensive report on this to be given to me within a week,” Somashekhar said.

Many sugar factories are owned by politicians. “There’s no question of protecting anyone,” he added.

“I have asked for details such as which sugar factory owes how much, who the owner is, when the loan was given and so on. I will make these details public once I get them,” the minister said.

Somashekhar said he had directed officials to come out with a policy to govern lending to sugar factories. “Lending should be based on repayment capacity,” he said. It was also decided to organize a statewide ‘loan mela’ to help the poor and middle class, Somashekhar announced.

The DCC banks in Belagavi, Kalaburagi, Bengaluru and Mysuru divisions will be made ‘Janasnehi’ (people-friendly) banks and steps will be taken to extend credit facilities to the poor, middle-class people, he said.

So far, DCC banks have given crop loans worth Rs 842 crore to 1.10 lakh farmers SC/ST farmers. Overall, 22.52 lakh farmers got Rs 13,577 crore in crop loans in 2019-20 fiscal.

“Repayment rate is 94%, which is good,” Somashekhar noted. The credit target for 2020-21 is Rs 14,500 crore for 24.50 lakh farmers, he said.

During the Covid-19 pandemic, 41,836 Asha workers out of the total 42,537 have received an incentive of Rs 3,000 each. “The incentive will be distributed among the rest soon,” the minister said.