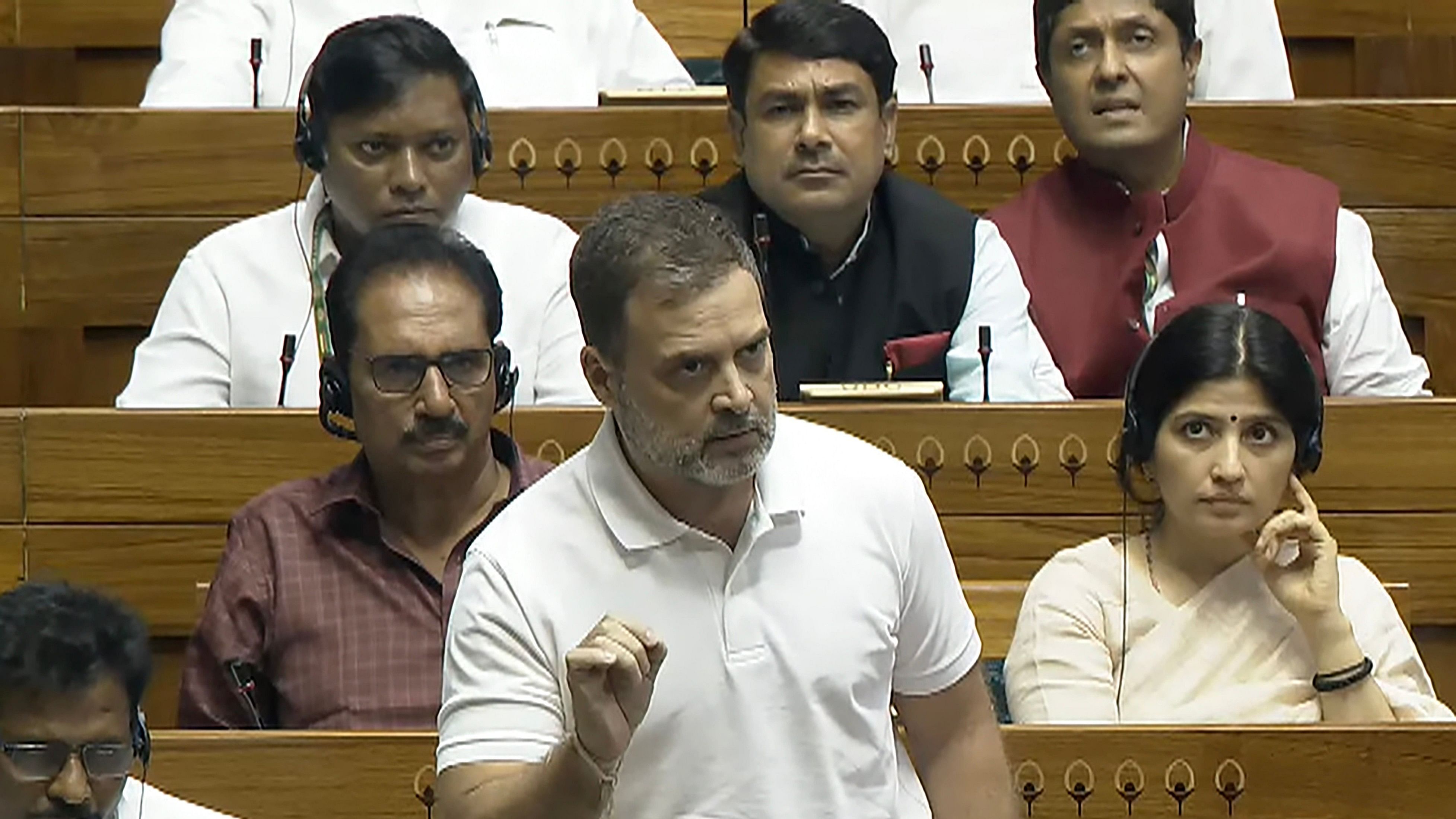

Leader of Opposition in Lok Sabha and Congress MP Rahul Gandhi speaks in the House during the Monsoon session of Parliament, in New Delhi, Tuesday, July 30, 2024.

Credit: PTI Photo

New Delhi: Twelve Public Sector Banks have collected Rs 8,494.82 crore as penalty from account holders for not maintaining ‘minimum balance’ in their accounts in the past five fiscals, prompting top Congress Leader Rahul Gandhi to claim that “empty pockets” of common man are being “robbed” during “Narendra Modi’s ‘Amrit Kaal’.”

The government shared the data of 12 banks, which collected the penalty between 2019-20 and 2023-24 in a written reply to questions raised by MPs V Selvaraj, K Subbarayan and Mala Roy in Lok Sabha on Wednesday.

The highest amount of penalty of Rs 2,331.08 crore was collected in 2023-24 and the Punjab National Bank topped the list with Rs 1,537.87 crore in five years.

SBI stopped collecting such penalties from customers from March 2020 though in 2019-20, it took Rs 640.19 crore, the highest for a bank in a fiscal, while the total penalty collected by banks was Rs 1,737.65 crore.

In 2020-21 during Covid-19 pandemic, banks collected Rs 1,142.13 crore and it rose to Rs 1,428.53 crore in the next fiscal. In 2022-23, it further rose to Rs 1,855.43 crore.

According to the reply by Minister of State for Finance Pankaj Chaudhary, India Bank came second after PNB in collecting a penalty of Rs 1,466.35 crore followed by Bank of Baroda Rs 1,250.63 crore and Canara Bank Rs 1,157.89 crore.

Bank of India collected Rs 827.53 crore, Central Bank of India Rs 587.21 crore, Bank of Maharashtra Rs 470.79 crore, Union Bank Rs 414.93 crore, Uco Bank Rs 66.44 crore, Punjab and Sindh Bank Rs 55.24 crore and Indian Overseas Bank Rs 19.75 crore.

Referring to the response, Leader of Opposition in Lok Sabha Rahul posted on ‘X’, “The government, which had forgiven Rs 16 lakh crore of friendly industrialists, has recovered Rs 8,500 crore from the poor Indians who were unable to maintain even 'minimum balance'.”

Invoking the ‘chakravyuh’ leitmotif he used during the debate on budget, he said, “the 'penalty system' is that door of Modi's 'chakravyuh' through which efforts are being made to break the back of the common Indian. But remember the people of India are not Abhimanyu but Arjun, they know how to answer your atrocities by breaking the 'chakravyuh'.”

On Monday, he said an atmosphere of fear prevails all around with a group of six trapping the entire country in a “chakravyuh”, which he said would be broken by the I.N.D.I.A. bloc.

Roy, a Trinamool Congress MP who was one of the lawmakers who raised the query said, “The hard-earned money of the poor is snatched by the banks.”

CPI Rajya Sabha floor leader P Sandosh Kumar told DH, “The banks are behaving like local money lenders who snatch money from the poor. They are doing this to reduce their losses incurred due to writing off the rich businessmen’s loans. Another such loot is done through charging money for ATM transactions.”