The first sows arrived in late September at the hulking, 26-story high-rise towering above a rural village in central China. The female pigs were whisked away dozens at a time in industrial elevators to the higher floors where the hogs would reside from insemination to maturity.

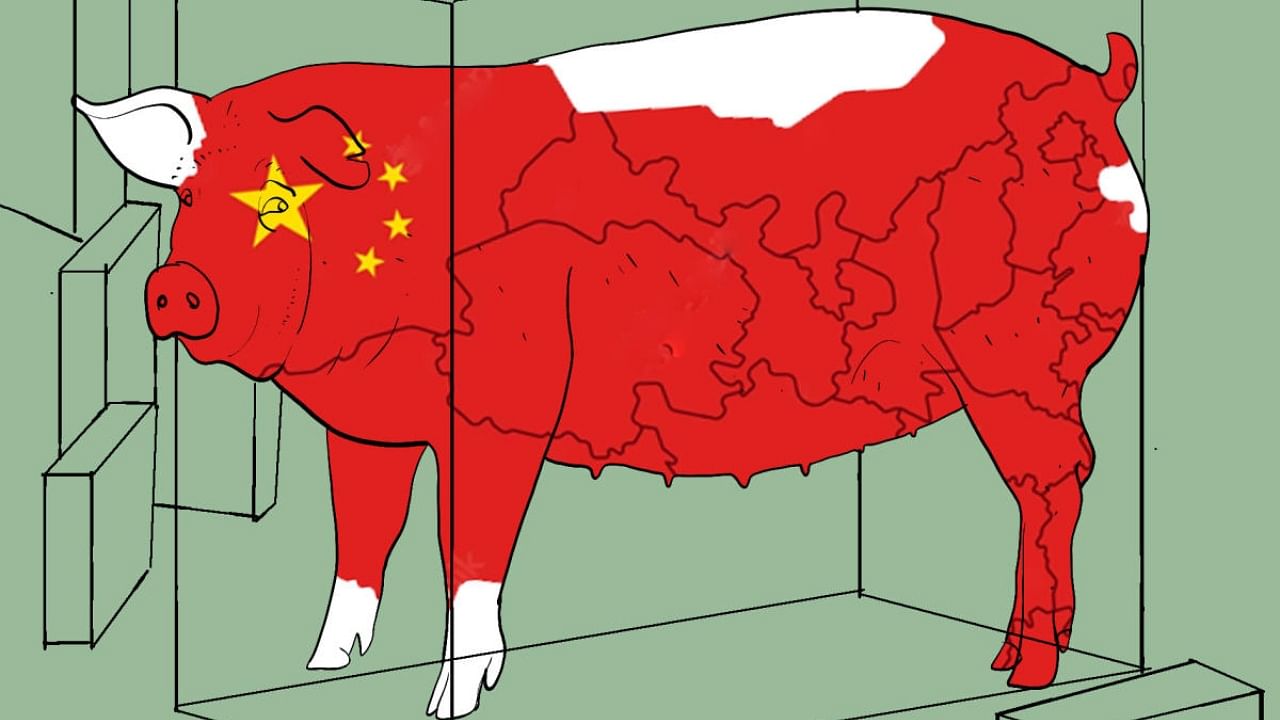

This is pig farming in China, where agricultural land is scarce, food production is lagging and pork supply is a strategic imperative.

Inside the hulking edifice, which resembles the monolithic housing blocks seen across China and stands as tall as the London tower that houses the Big Ben, the pigs are monitored on high-definition cameras by uniformed technicians in a NASA-like command centre. Each floor operates like a self-contained farm for the different stages of a young pig’s life: an area for pregnant pigs, a room for farrowing piglets, spots for nursing and space for fattening the young hogs.

Feed is carried on a conveyor belt to the top floor, where it’s collected in giant tanks that deliver more than one million pounds of food a day to the floors below through high-tech feeding troughs that automatically dispense the meal to the hogs based on their stage of life, weight and health.

The building, located on the outskirts of Ezhou, a city on the southern bank of the Yangtze River, is being hailed as the world’s biggest free-standing pig farm with a second identical hog high-rise opening soon. The first farm started operating in October, and once both buildings reach full capacity later this year, it is expected to raise 1.2 million pigs annually.

China has had a long love affair with pigs. For decades, many rural Chinese households raised backyard pigs, considered valuable livestock as not only a source of meat but also manure. Pigs also hold cultural significance as a symbol of prosperity because, historically, pork was served only on special occasions.

Today, no country eats more pork than China, which consumes half of the world’s pig meat. Pork prices are closely watched as a measure of inflation and carefully managed through the country’s strategic pork reserve — a government meat stockpile that can stabilise prices when supplies run low.

But pork prices are higher than in other major nations where pig farming went industrial a long time ago. In the last few years, dozens of other mammoth industrialised pig farms have sprung up across China as part of Beijing’s drive to close that gap.

Built by Hubei Zhongxin Kaiwei Modern Animal Husbandry, a cement manufacturer turned pig breeder, the Ezhou farm stands like a monument to China’s ambition to modernise pork production. “China’s current pig breeding is still decades behind the most advanced nations,” said Zhuge Wenda, the company’s president. “This provides us with room for improvement to catch up.”

The farm is next to the company’s cement factory, in a region of the country known as the “Land of Fish and Rice” for its importance to Chinese cuisine with its fertile farmlands and surrounding bodies of water. A pig farm in name, the operation is actually more like a Foxconn factory for pigs with the precision required of an iPhone production line. Even pig feces is measured, collected and repurposed. Roughly one-quarter of the feed will come out as dry excrement that can be repurposed as methane to generate electricity.

Six decades after a famine killed tens of millions of its people, China still trails most of the developed world when it comes to efficient food production. China is the biggest importer of agricultural goods, including more than half of the world’s soybeans, mostly for animal feed. It has about 10% of the planet’s arable land for around 20% of the global population. Its crops cost more to produce and its farmlands yield less corn, wheat and soybean per acre than other major economies.

The shortcomings became more pronounced in the last few years when trade disputes with the United States, pandemic-related supply disruptions and the war in Ukraine underscored China’s potential food security risk. In a December policy address, Xi Jinping, China’s leader, called agricultural self-reliance a priority.

“A country must strengthen its agriculture before making itself a great power, and only a robust agriculture can make the country strong,” Xi said. In the past, he has warned that China would “fall under others’ control if we don’t hold our rice bowl steady.”

And no protein is more important for the Chinese rice bowl than pork. The State Council, China’s Cabinet, issued a decree in 2019 stating that all government departments needed to support the pork industry, including financial aid for more large-scale pig farms. In the same year, Beijing also said that it would approve multistory farming, which allowed pig farming to go vertical to raise more hogs on relatively smaller parcels of land.

“This is a milestone and not only for China, because multistory farms will have an impact on the world,” said Yu Ping, executive director of Yu’s Design Institute, a company that designs pig farms.

As China has modernised with hundreds of millions of people moving from the countryside to urban centers, small backyard farms have disappeared. The total number of pig farms in China producing fewer than 500 hogs a year has plunged 75% since 2007, to around 21 million in 2020, according to an industry report.

The shift toward mega-farms accelerated in 2018 when African swine fever ravaged China’s pork industry and wiped out, by some estimates, 40% of its pig population.

Brett Stuart, founder of Global AgriTrends, a market research firm, said hog towers and other giant pig farms exacerbate the biggest risk facing China’s pork industry: disease. Raising so many pigs together in a single facility makes it harder to prevent contamination. He said large US pork producers spread out their farms to reduce biosecurity risk.

“US hog farmers look at the pictures of those farms in China, and they just scratch their heads and say, “We would never dare do that,” said Stuart. “It’s just too risky.”

But when pork prices tripled in a year, coupled with Beijing’s support of large-scale pig farms, the rewards appeared to outweigh the risk. A building boom ensued, and a market constrained by supply became overwhelmed with available pigs. Pork prices are down roughly 60% from 2019 highs. China’s pork industry is marked by bitcoin-like volatility, riding boom-or-bust cycles that spin off huge profits or losses depending on the wild price swings.

In rural areas, where backyard farms once dotted the countryside, mega-farms are sprouting up. Three years ago, as property and infrastructure sectors started to slump, Hubei Zhongxin Kaiwei decided to use a neighbouring plot of land and apply its construction expertise to branch out into a business with better growth prospects. It invested $600 million to build the high-rise pig farms with an additional $900 million earmarked for a nearby meat processing plant.

Its background in cement is useful in pig farming, the company said. Using its existing employees, it built a land-saving high-rise with reinforced concrete. It is using excess heat from the cement factory to provide hot baths and warm drinking water to the pigs. This, according to Hubei Zhongxin Kaiwei, will help the pigs grow faster with less feed.

Small backyard pig farmers are finding it hard to keep pace with that type of scale.

(The New York Times)