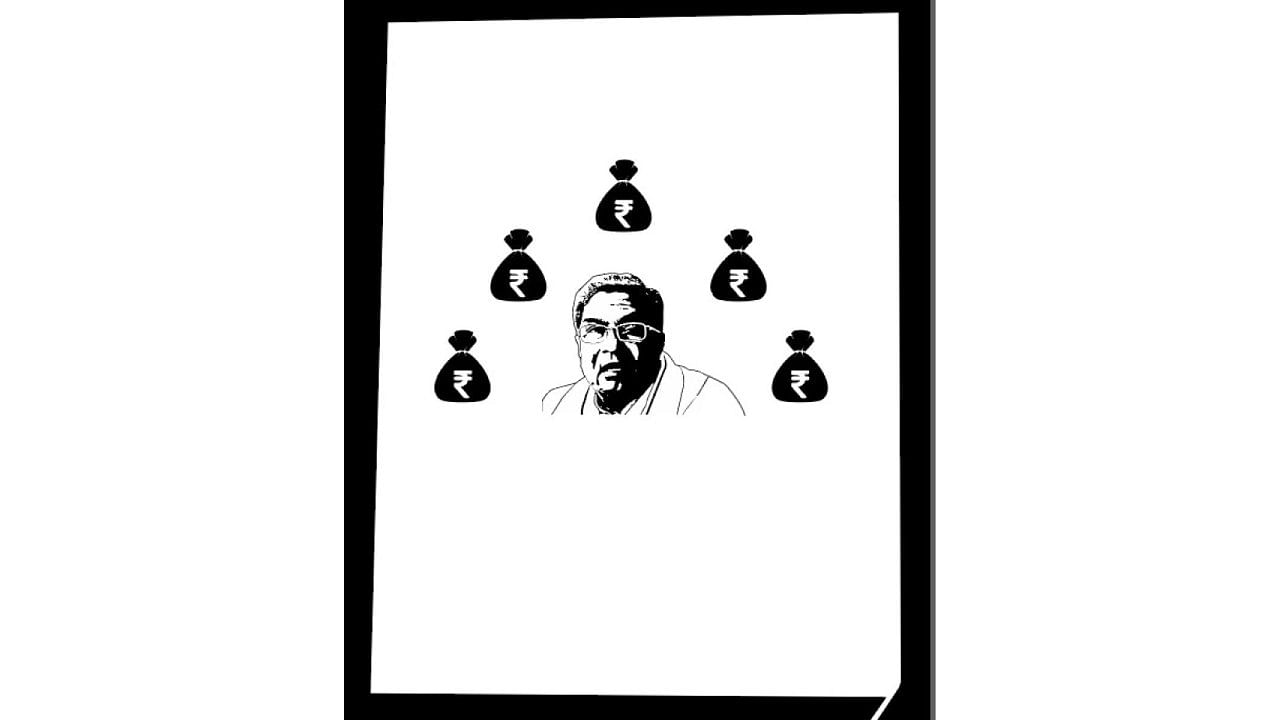

The Karnataka State Budget 2023–24 presented by Chief Minister Siddaramaiah is like an elephant—hard to define but can be described.

Siddaramaiah has to be congratulated for presenting his 14th budget—the most by any FM or CM of Karnataka and his seventh as chief minister, which is no ordinary feat.

The present budget undoubtedly reflects the ‘Lohia values’ and the ‘socialist leanings’ of Siddu. It is more of a ‘welfare’ budget that aims at social equality and the redistribution of

income and wealth from the haves to the have-nots.

Riding to power on the five ‘guarantees: Gruhalakshmi (Rs 2,000 to every woman head of the family), Annabhagya (10 kg rice to BPL and Antyodaya card holders), and Gruhajyothi (free power of 200 units with riders), Shakthi (which entails free bus travel to all women/girl students including transgenders) and Yuva Nidhi (Rs 3,000 per month to unemployed graduates and Rs 1,500 to diploma holders with conditions), Siddaramaiah has very intelligently brought all the schemes (except Yuva Nidhi) under the budget, allocated appropriate funds required for the them for the residual nine months of the financial year (July 2023 to March 2024) and planned for raising the requisite resources for funding of the 4Gs.

With an all-time high budget size of Rs 3.27 lakh crore, the CM has allocated Rs 30,000 crore for Gruhalakshmi, Rs 13,910 crore for Gruha Jyothi, Rs 4,000 crore for Shakthi, and Rs 10,000 crore for Annabhagya schemes.

Known for his fiscal prudence and financial acumen, the CM has laid hands on the low-hanging fruits for mopping up resources to fund the guarantees.

People who ‘drink alcohol’ are always the first target for raising funds. The budget has raised excise duty on Indian Manufactured Liquor (IML) by 20% and on beer by 10%, which will facilitate the realisation of the Rs 36,000 crore excise target for the financial year. It is ironic and sad that this kind of ‘spirit money’ is used to fund women’s welfare schemes.

It would be desirable to spare the hike in excise duties at least in the lower slabs (the hike has been in all 18 slabs) to prevent the vulnerable classes from turning to illicit liquor, which will lead to grave moral and health hazards.

Targeting the more affluent and affordable classes, the budget envisages a revision in the guidance value of all the properties, which was last done in 2019. This results in four-pronged benefits:

1. The properties will reflect market valuations, which will almost be in sync with the guidance value or SR value.

2. This will gradually phase out the ‘cash component’ transactions in property sales, the epicentre for generating black money and corresponding ills in the economy.

3. The raising of the guidance value of properties in this budget is expected to mop up Rs 25,000 crore in the present financial year from stamps and registration fees.

4. Realistic valuations will help the purchasers of properties get more housing loans from banks and housing finance companies.

It would be desirable to have the increase in stamps and registration fees, which aims at Rs 25,000 crore revenue for the year, on a slab basis by leaving the purchasers of houses under the ‘affordable segment’ of properties valued at less than Rs 40 lakh untouched and can steeply charge for purchasers of properties above Rs 1.5 crore.

The budget also proposes an increased tax on purchasers of new vehicles. The resource mop-up for the year is to the extent of Rs 11,500 crore. It would be appropriate not to tax motor vehicles and EVs that are priced less than Rs 10 lakh and less than 1,000 cc and levy heavy taxes on ‘high-end’ automobile purchasers.

Rs 1.01 lakh crore will flow through commercial taxes, including Rs 2,350 crore from GST compensation. The ambitious target is prompted by the buoyant state economy, which is poised to realise a GSDP of Rs 25.67 lakh crore, with the first quarter of this year (April–June) already fetching Rs 18,962 crore.

The rest of the funding for both revenue and capital expenditure will be sourced through borrowings amounting to Rs 85,818 crore, leaving a revenue deficit of Rs 12,522 crore. The cumulative loan outstanding for the state will be Rs 5.71 lakh crore.

If the chief minister is really serious about the Annabhagya scheme of providing 5 kg of rice plus the cash equivalent of an additional 5 kg of rice or food grains to the BPL householders, for which an allocation of Rs 10,000 crore has been allocated for the cash component portion, there is a need to identify the real BPL beneficiaries. Data shows that there are 4.2 crore beneficiaries under the BPL, which means that 60–65 per cent of our state’s population is poor. This is ridiculous. A substantial number of BPL cardholders are above the ‘poverty line’ and are affluent.

Fake BPL cards are in circulation. Honest taxpayers’ money is used to feed undeserving beneficiaries. The amount saved can be used for quality spending and developmental activities.

The CM has won the battle by providing Rs 52,000 crore for funding the guarantees by raising excise duty, motor vehicle taxes, and the proposed increase in the guidance value of properties, which will yield higher stamps and registration fees.

But the real challenge and the tightrope walk for the CM will be to comply with the Fiscal Responsibility Act (FRA), which has already been breached under 1 of the 3 parameters with a negative revenue deficit of Rs 12,500 crore.

With little elbow space for revenue generation and beneficiaries under the 5-Gs remaining the same or higher, the threat to fiscal stability will be even more pronounced.

(The writer is a former banker)