By Andrew Duehren

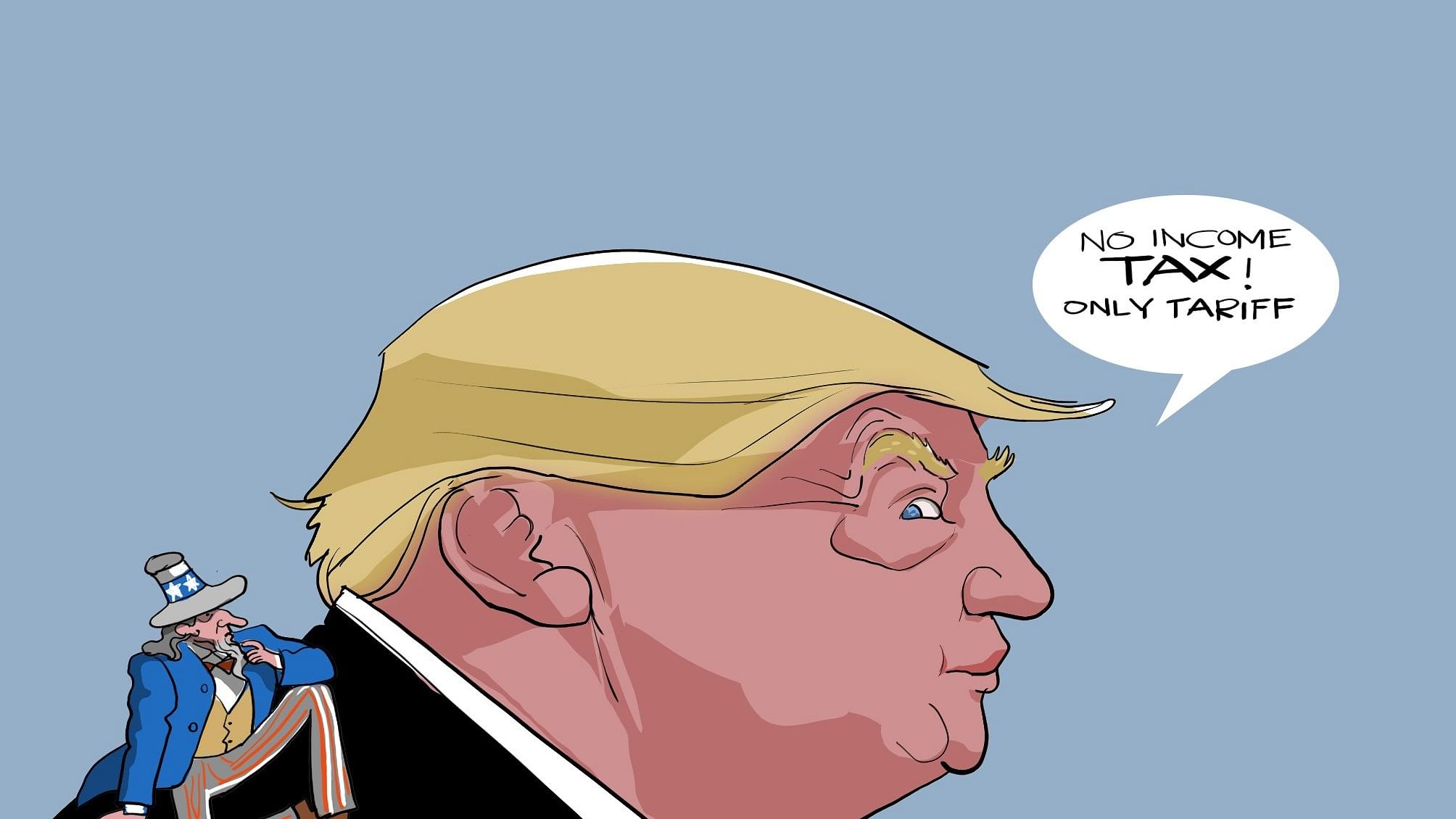

Former President Donald Trump has spent much of the presidential campaign brainstorming new, and sometimes untested, ways to cut taxes. In the election’s final stretch, he raised the possibility of going even further: eliminating income taxes entirely.

During a Fox News segment on October 21, Trump took questions at a barbershop in New York City. When asked if the United States could potentially end all federal taxation, Trump said the country could return to the economic policies in the late 19th century, when there was no federal income tax.

“It had all tariffs; it didn’t have an income tax,” Trump said. “Now we have income taxes, and we have people that are dying. They’re paying tax, and they don’t have the money to pay the tax.”

In June, Trump floated the idea of replacing federal revenue from income taxes with money received from tariffs. Trump has not provided specific details of how that would work, and it is unclear if he wants to eliminate all federal taxes, including corporate income taxes and payroll taxes, or only end the individual income tax.

Either way, liberal and conservative experts have dismissed his idea as mathematically impossible and economically destructive. Even if Republicans control Congress, lawmakers are unlikely to dismantle the income tax system. Yet Trump’s combination of tax cuts and tariff increases has been central to his political pitch.

“There is a way, if what I’m planning comes out,” Trump said of ending income taxes.

Replacing income taxes with tariffs would reverse the progressivity of the tax system in the United States. In general, income taxes are progressive, meaning that Americans with more income pay a higher tax rate. Tariffs, which impose a tax on products imported into the United States, are regressive. They raise the prices on imported items like clothing and groceries, placing a larger burden on lower-income Americans who spend a bigger percentage of their income on those goods.

Trump has denied that Americans pay the cost of tariffs. He argues that companies overseas bear the cost of tariffs on the products they ship to the United States. Economists largely debunk that argument — companies generally pass along those higher costs to consumers by raising prices.

Why does the US have income taxes?

The United States put income taxes in place to achieve two main goals: raising taxes on the rich and paying for a larger federal government.

The country briefly had an income tax during the Civil War, but it was not until Trump’s favourite historical period — the late 19th century — that the idea gained ground again. Tariffs largely funded the federal government, but Democrats of that era wanted to collect more money from the wealthy by charging an income tax.

In the late 1800s, Democrats, led by William Jennings Bryan, attacked tariffs as a burden on poor Americans. Republicans supported tariffs as a way to protect the domestic industry from foreign competition.

“There was a real concern about inequality, just as there is today, as there were great disparities in wealth and poverty in the Gilded Age, and so the income tax was seen as a necessary leveller by its proponents,” said Steven R Weisman, the author of a book on the history of the income tax in the United States.

Actually creating a federal income tax was ultimately an involved process, requiring the ratification of the 16th amendment in 1913. At first, it was narrowly targeted at wealthy individuals and corporations, but fighting two world wars and creating programs like Social Security was expensive. American policymakers turned to income taxes to pay for those priorities.

“It becomes a mass-based income tax for the first time during World War II,” said W Elliot Brownlee, a historian of tax policy at the University of California, Santa Barbara.

Tariffs dwindled as a source of federal revenue, while income taxes expanded. Today, tariffs make up just 2% of federal revenue, while income and payroll taxes make up about 94%. Overall, the tax system is progressive: In 2020, the top 20% of earners in the United States paid about 80% of all federal taxes, according to the Congressional Budget Office.

Trump’s alternative? Tariffs

Trump has not formally proposed ending the income tax system in the United States. Instead, he has offered tax cut after tax cut on the campaign trail, arguing that he could cover their cost by drastically raising tariffs on imports.

Several of Trump’s ideas amount to blanket tax exemptions for certain types of income, like tips, overtime pay or Social Security benefits. During a podcast interview last week, Trump said he would consider allowing police officers, firefighters and military service members to forgo paying taxes.

Any change to the tax code that allows certain workers or types of income to be exempt from paying taxes could prompt people to try to classify more of their earnings as tips or overtime, making the cuts potentially very expensive.

Trump’s goal to impose tariffs on all imports into the United States could raise a lot of money for the federal government, but it would not be nearly enough to replace income taxes.

The United States imports roughly $3 trillion worth of goods annually, while the country collected roughly $4.2 trillion in income and payroll taxes last fiscal year.

Overall, his agenda would raise taxes on low-income Americans, provide a tax break for the richest and drastically increase the deficit, according to an analysis from the Institute on Taxation and Economic Policy, a liberal think tank.

A challenge for raising revenue from tariffs is that placing a tax on imports tends to cut the amount of trade — and therefore reduce the amount of revenue collected from tariffs. Raising tariff rates high enough to try to replace income taxes could end trade with the United States, said Wendy Edelberg, a former chief economist at the Congressional Budget Office.

“You’re going to send imported goods to zero, and then you’re going to have no tax revenue,” Edelberg said.

Steep tariffs could prompt foreign trading partners to retaliate with tariffs of their own, reducing US exports and slowing economic growth.

Trump has experience with this phenomenon: While president, he wound up having to bail out American farmers whose exports to China slumped during a protracted trade war.

The potential for such an outcome helped prompt William McKinley, the 25th president, a Republican, whose support for tariffs Trump often celebrates, to ultimately moderate his position on tariffs.

To help US exporters, McKinley had started to support the possibility of lowering tariffs in the United States in exchange for other countries doing

the same before he was assassinated in 1901.

“He outlined this and sounded like a free-trade guy, which was quite remarkable,” said Robert Merry, who wrote a book on McKinley.