During school holidays spent with my mother’s family, Ajja (maternal grandfather) would take me along on his walks and chit-chat about stuff he couldn’t directly ask his daughter. Once, when I was 10, he sheepishly asked if my father had any “upar-e”. I thought “upar-e” meant another wife; so, I shook my head vigorously. I remember then being surprised that Ajja seemed upset about it. Years later, I discovered that “upar-e” meant extra income — monies a jobholder those days could earn above his salary through bribes, commissions, or embezzlement at the office, even in the private sector. It was the 80s, and “upar-e” was perhaps the only way for the salaried middle class to retire rich.

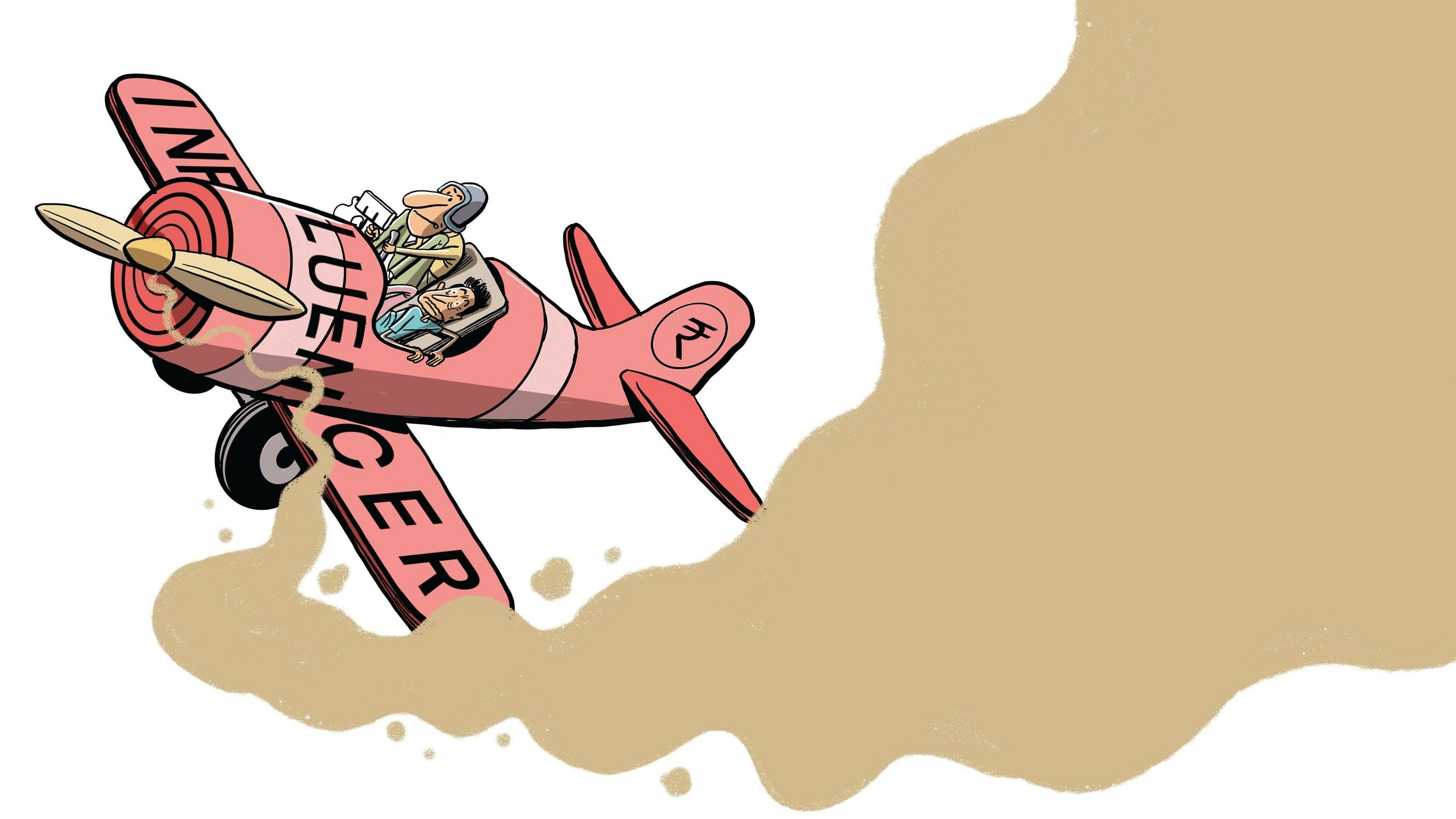

Today, it’s a different story. There’s more disposable income and more investment avenues. So, egged on by financial influencers, or finfluencers, on YouTube, TV, and social media, hordes of people are lapping up all kinds of “strategies” and “recommendations” to be able to retire not just rich but also early.

But, are they really getting “expert” advice? Or, is this a misplaced frenzy?

Destination F.I.R.E.

No one knows who first coined the acronym F.I.R.E. But the idea may have originated from the 1992 bestseller Your Money or Your Life, which popularised early retirement through frugal living and aggressive investing. F.I.R.E. caught on in India during the 2020-22 lockdowns, thanks to several enabling circumstances.

As a response to the pandemic, many financial technology apps and products had been launched. They were all vying for the eyeballs of their target customers through advertisements on finance-related YouTube channels. So, suddenly, the personal finance and investment niche became rather lucrative for content creators, who started coming in droves to this space. Existing channels in this category had the first-mover advantage but even those in other content categories — like self-growth — pivoted and jumped on the personal finance and investment bandwagon.

This ever-growing brigade of financial content creators had plenty to talk about, “analyse”, and “recommend” as the stock market unexpectedly started making big gains after a gloom-and-doom phase in early 2020. Cryptocurrency too took a sharp upward trajectory. To consume all this content, there was an eager audience in the lakhs of well-paid, bored, young people working from home. Many started dabbling in various investments, perhaps for the first time in their lives, and got hooked by the quick gains. The government’s investment promotion agency Invest India reports that around 10.7 million retail investors opened Demat accounts between April 2020 and January 2021. Blockchain data platform Chainalysis has a similar report indicating that cryptocurrency investments in India zoomed around this time.

As the trend played out, financial content creators who had grown big enough to be considered influencers, took to talking about hitherto offbeat subjects like early retirement and multiple income sources. Gradually, a narrative got built, and it was this: early retirement was an achievable and actionable goal. With steady, strategic, and preferably copious investments in asset classes like equities, an adequate corpus could be built to retire early for a more fun-filled and fulfilling life. Additionally, one could actually retire earlier than early by creating other income sources besides the job, like Airbnb-ing a rental property or doing “low-risk stock trading” on the side.

This was a compelling discourse for many, especially those in their 20s and 30s with lifestyle aspirations, job insecurities, and the hope to reach a stage in which the “chilling” at home they had got used to became permanent in their lives. As is apparent now, there were many takers of this idea.

During a recent, long train journey, I met a 30-something Bengaluru-based IT professional. After some small talk about our backgrounds, he casually mentioned that he had shifted to train travel to be able to reach his F.I.R.E. number (the corpus size one aims to achieve F.I.R.E.). I was not expecting to hear about F.I.R.E. in a train, but it flummoxed me more when a 10th Grader nearby perked up and said that he had been day-trading through his father’s account to be able to make enough early and retire at 30. When I asked why he wanted to retire that early, he replied: “to chill”.

The posers in any “Ask our Personal Finance Expert” forum or the ‘Comments’ section of any finfluencer channel or page are equally revealing these days. Most have a bunch of F.I.R.E.-related questions — will a certain investment grow to a certain size in a certain period; will a certain targeted sum suffice post-retirement...you get the drift.

Red flags on the way

People making the journey towards financial freedom, with directions from kind strangers who supposedly know the way — what could be problematic here? Indeed, chasing the F.I.R.E. dream is a matter of personal choice. But those making the journey are probably being led up the garden path by some of the guidance they are getting.

The rise of finfluencers is actually a mixed story. They have nudged people to save more and created much-needed financial literacy. But the demands of the modern-day creator industry have brought in three kinds of problems to this space — exaggeration, obfuscation, and corruption.

Let’s consider the first. With the constant pressure to make engaging content, some finfluencers flaunt their post-early retirement ‘good life’ in posh houses, restaurants, or travel destinations. They also talk about their various unconventional investments — like selling an online course or creating rental properties. In thumbnails and titles, they even claim enormous figures as their net worth. The goal clearly is to create the perception that the strategies they preach have made them really successful. In the circumstances, F.I.R.E. is unduly romanticised and made to look easy.

The F.I.R.E. journey requires focus and commitment to a pre-defined plan and there’s no scope for trial-and-error investing in many areas. Dr M Pattabiraman — an IIT-Madras associate professor who runs Freefincal, a portal dedicated to unbiased dissemination of stock market and personal finance knowledge — told DHoS that while "talking about their own F.I.R.E. journey, many finfluencers tend to focus merely on the investing skills involved and rarely open up about all aspects of the journey.”

Speaking of obfuscation, there’s a whole catalogue of transgressions. Finfluencers often use every trick in the trade to push a convenient narrative — selectively using historical data to predict future performance or overgeneralising a concept. Take for instance a finfluencer holding forth on value investing (picking undervalued stocks and holding onto them until the market realizes their value) by focusing merely on current low prices and not elaborating on why the prices of the assets could be depressed. Another example is a finfluencer promoting the idea of making bada paisa (big gains) by putting all the money into only stocks, without a care for some degree of asset diversification. On a similar note, Fundamental Investor (@FI_InvestIndia), an early retiree who is widely followed on X for anonymous posts on investing insights, told DHoS that finfluencers even go to the extent of encouraging people to trade actively, a high-risk activity, to beat Inflation.

Corruption is one wrongdoing finfluencers have found it hard to get away with. Over the past two years, there have been many occasions when the stock market regulator SEBI has reined in finfluencers for various offences, including market manipulation. In June this year, it was deemed unlawful for financial influencers to advise on specific stocks. It also asked registered entities to cut ties with such finfluencers.

Unfortunately, regulators and authorities can only flag off unlawful activities in the stock market, which is just a part of the F.I.R.E.-related discourse, albeit large. There are many personal finance concepts and asset classes finfluencers routinely misrepresent, but there’s no calling that out.

Passenger or pilot?

If you follow finfluencers for personal finance or early-retirement planning, how should you navigate their world? Here’s a practical dos and don’ts list distilled from observing the ecosystem.

1. Swap the passenger seat for the pilot’s. Instead of taking every piece of advice or narrative to heart, look at personal finance as professional upskilling. Study and be discerning if you are Doing It Yourself (DIY). Otherwise, approach a professional financial planner. But to pick one and assess his quality, you would still need an understanding of concepts and asset classes.

2. Be mindful of 'conflict of interest' — will the insight or advice help its giver professionally or financially? It’s not just stock recommendations; promotional and marketing materials are often passed off as “valuable insight”. Think about, for instance, a real estate developer talking about the benefits of investing in commercial properties or an index fund manager talking about the benefits of passive investing. Dr Pattabiraman even believes that in general, true DIY investors should do their own research and avoid all finfluencers.

3. Nuance and context matters. Knowledge about personal finance and investment principles is widely, freely, and plentifully available. And, finfluencers sometimes simply regurgitate what they have read or heard elsewhere. Fundamental Investor has a good example: “India's Inflation is not YOUR Inflation. So, using the 7% rate to factor in inflation in your calculations just doesn't make sense.” Frame all investment principles, advice and narratives into your personal circumstances and then take the call.

4. Invest in what you understand. Legendary investor Warren Buffet famously didn’t invest in technology stocks for a long time because he “didn’t understand the sector.” FOMO or the Fear Of Missing Out goes hand in hand with investments, of any kind. If you don’t understand the dynamics of or risks involved in a particular asset class or investing style, fight the impulse to jump in just because you are hearing good things about it. Without getting into the merits of crypto or options trading, one can safely say that they are opaque, complex or both and not suitable for all investors.

5. Finfluencers often flit between asset classes, promoting one and dishing the other whimsically. However, all conventional asset classes have a role to perform. Be clear about it while deciding your allocations to each.

Is retirement a number or an idea?

For F.I.R.E. seekers, the ‘F.I.R.E. Number’ is an oasis in the desert. From afar, it has the promise of relief, joy, and comfort but reaching it requires an arduous journey. There’s also a dilemma — is it real, or a mirage? F.I.R.E. seekers obsess about this number because a target corpus size is necessary to make plans. It’s also a big deal because the corpus should not fall short in retirement. Besides, there could be a large unexpected expense or higher-than-anticipated long-term inflation. There are free retirement calculators, but there’s also a popular method for ballpark calculations: 30-40 times current annual expenses — assuming there’s a place of residence without EMI, a separate corpus for children’s education, and adequate health insurance — for retirement in the 40s. 50 times is considered safe for an even earlier retirement.

That said, F.I.R.E. seekers would do well to ask themselves if they are chasing a number or an idea. In its truest sense, retirement, early or otherwise, should be about living with autonomy, on one’s own terms and doing what one really believes in.

Disclaimer: This is a social trend article and no part of this should be construed as financial advice.

The author looked after marketing, strategic, and client communications at a U.S.-headquartered global investment and wealth management company for more than a decade. In early 2018, he capped a 20-year career and quit working for a salary to pursue only his interests.