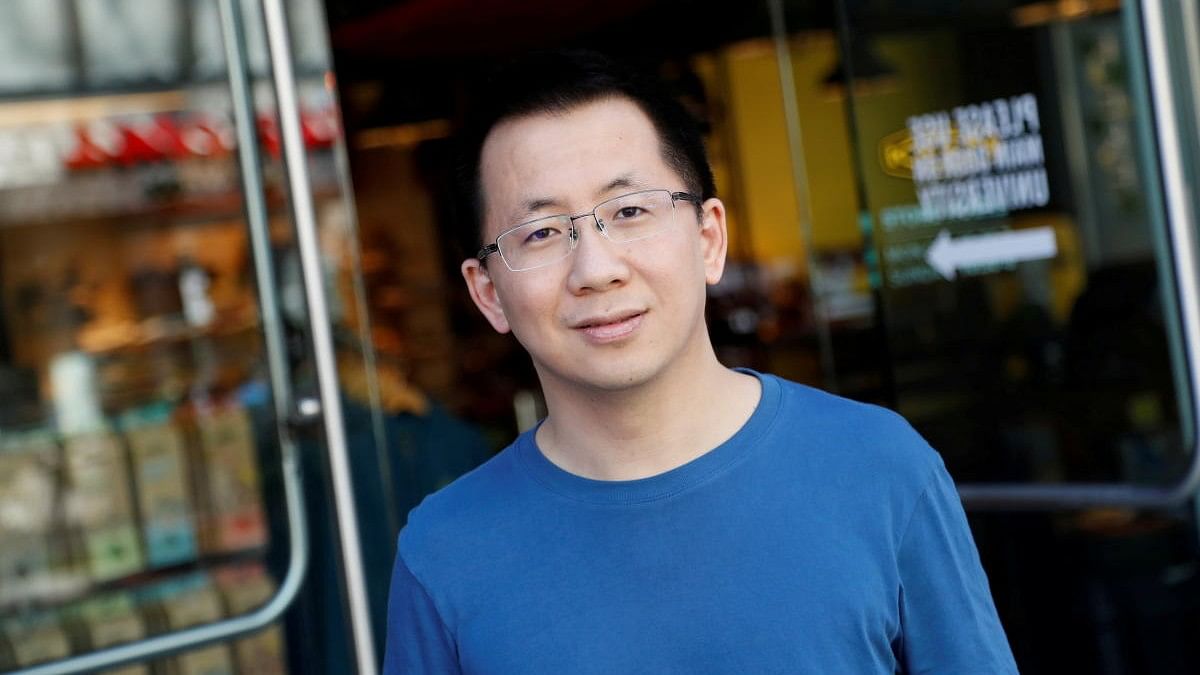

ByteDance founder Zhang Yiming

Credit: Reuters Photo

Shanghai: ByteDance founder Zhang Yiming is China's richest person, with personal wealth of $49.3 billion, an annual rich list showed on Tuesday, although counterparts in real estate and renewables have fared less well.

Zhang, 41, who stepped down as chief executive of ByteDance in 2021, becomes the 18th individual to be crowned China's richest person in the 26 years since the Hurun China Rich List was first published.

He overtook bottled water magnate Zhong Shanshan, who slipped to second place as his fortune dropped 24 per cent to $47.9 billion.

Despite a legal battle over its US assets, ByteDance's global revenue grew 30 per cent last year to $110 billion, Hurun said, helping to propel Zhang's personal fortune.

Third on the list was Tencent's low-profile founder, Pony Ma, while Colin Huang, founder of PDD Holdings, slipped to fourth place from third last year, even as his firm's discount-focused e-commerce platforms, Pinduoduo and Temu, continue to show healthy revenue growth.

The number of billionaires on the list dropped by 142 to 753, shrinking more than a third from its 2021 peak.

"China’s economy and stock markets had a difficult year," said Hurun Report Chairman Rupert Hoogewerf.

The most dramatic falls in fortunes have come from China's real estate sector, he added, while consumer electronics is clearly rising fast, with Xiaomi founder Lei Jun adding $5 billion to his wealth this year.

"Solar panel, lithium battery and EV makers have had a challenging year, as competition intensified, leading to a glut, and the threat of tariffs added to uncertainties," said Hoogewerf, who is also the list's chief researcher.

"Solar panel makers saw their wealth down as much as 80 per cent from the 2021 peak, while battery and EV makers were down by half and a quarter respectively."