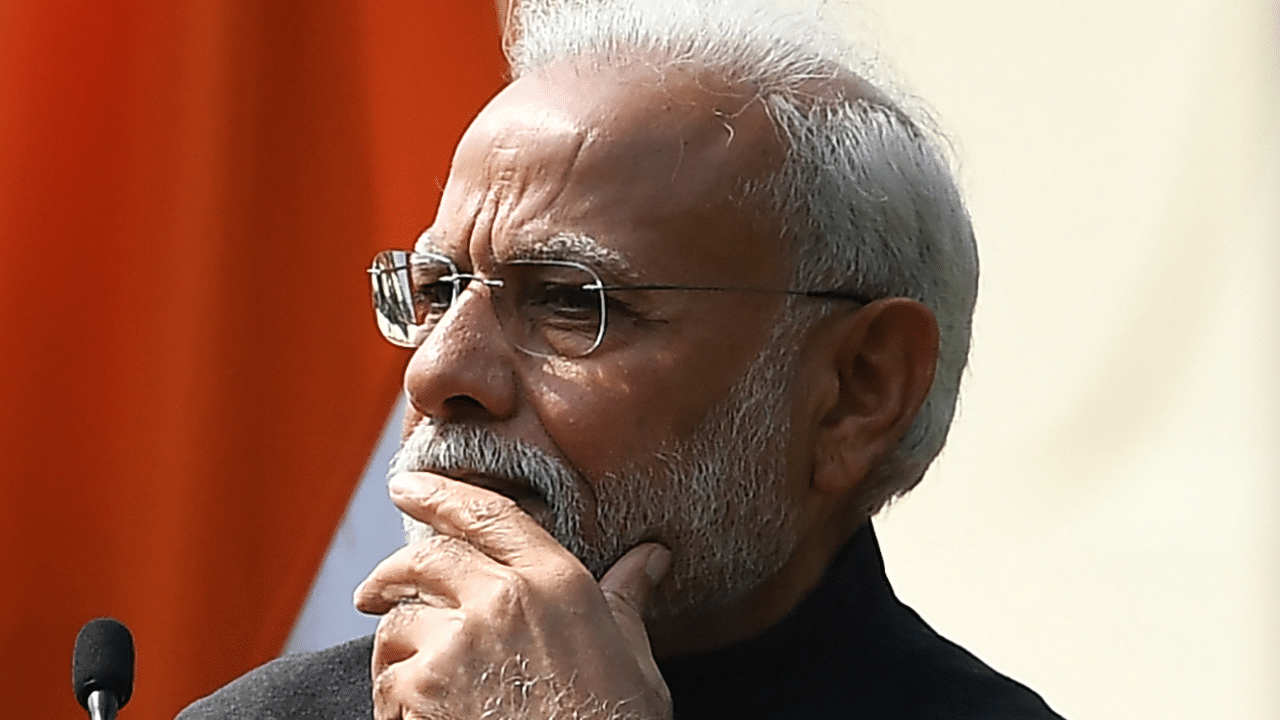

Questioning the rationale behind cutting corporate tax amid financial distress leading to a revenue loss of Rs 1.84 lakh crore, Congress on Tuesday charged the Narendra Modi government of hating the middle and lower income class, alleging that it was charging them a peak tax rate of 30 per cent, while corporates are taxed at a lower 22 per cent.

Emphasising that tax cuts given to middle- and lower-income groups could lead to increase in consumption, and as a result create more jobs, the Congress party also asked why the government was not exploring this option.

Congress spokesperson Gourav Vallabh said: “Why does the ‘suit-boot sarkaar’ hate the middle- and lower-income class?”

Vallabh said the Modi government had “repeatedly claimed” that corporate tax cuts would help increase corporate tax collection. However, according to him, the Parliamentary Committee on Estimates reported that the decision of corporate tax reduction—from 30 per cent to 22 per cent—for existing firms, and from 18 per cent to 15 per cent for new manufacturing units in September 2019 had resulted in a negative “revenue impact” of Rs 1.84 lakh crore.

The Congress spokesperson also claimed that the rate cut came amidst fiscal distress—the Union finance minister Nirmala Sitharaman had told all states at Goa’s Goods and Service Tax (GST) Council meeting that the Union government would not pay the GST compensation henceforth, as it did not have any money.

People taxed 30%, firms only 22%

Vallabh sought to link the announcement of corporate tax two days ahead of Prime Minister’s ‘Howdy Modi’ event in the United States, asking whether it was a “mandatory condition” put by the Americans before he set his foot there.

“What is more important for the government during a pandemic: Taking a negative revenue impact of Rs 1.84 lakh crore in two years due to a corporate tax cut, or increasing the MGNREGA budget to 2.26 times of the current allocation of Rs 73,000 crore?” Vallabh said.

"Why are such rate cuts limited to corporates? Why is the middle class taxed at a peak income tax rate of 30 per cent, that too without setting off the expenses, but corporates (are charged tax) at 15 or 22 per cent,” Vallabh asked.

He also announced that a new record was set 2020-21, when the total corporate tax collected was at Rs 4.57 lakh crore—but it was well below the income tax collection of Rs 4.87 lakh crore.

“For 2021-22, corporate tax cuts may give a revenue loss of more than Rs 1 lakh crore, sufficient for transferring Rs 20,000 per year per family to the bottom 20 per cent of families. What is more important?”

Corporates didn’t restart Capex cycle

Quoting the Reserve Bank of India, Vallabh said the corporate tax cut was used by the companies for debt servicing, building up cash balances and other current assets, rather than restarting the CAPEX cycle.

“In fact, in FY22, capital expenditure grew by a mere 2.3 per cent, a six-year low. So, there was no investment or job creation due to the corporate tax cut in India, and above this, corporate tax collection fell from Rs 5,56,876 crore in FY20 (actual) to Rs 4,57,719 crore in FY21 (actual) despite the increase in corporate profits,” he said.

“Tax cuts for the rich lead to higher income inequality in both the short- and medium-term. In contrast, such reforms do not significantly affect economic growth or unemployment,” Vallabh added.